For over two years, the government has been playing hide-and-seek with the memorandum of understanding (MOU), concealing the identity of the people behind the ill-fated Vitals Global Healthcare. The latest twist in this saga is that the MOU was suddenly “lost” and then, conveniently, was “found” again following national uproar. The Shift takes a look at what we know about this MOU and its importance.

In January 2018, Malta learnt of the existence of a secret memorandum of understanding (MOU) signed between the government and people linked to a controversial hospital concession, a full six months before the government even published a request for proposals (RfP) for this concession.

The government has, since then, stonewalled journalists’ questions, refused Freedom of Information requests, ignored parliamentary questions, and even fought in court to block access to this document, citing all manner of reasons, including confidentiality clauses and secrecy provisions in the Malta Enterprise Act.

Matters came to a head last week when the National Audit Office (NAO) concluded that the “public tender” for control of the hospitals was likely a predetermined deal, finding, among other serious failings, evidence of “collusion” between government officials and the promoters of Vitals Global Healthcare, before the tender was even issued.

This finding, among others, could potentially nullify the public tender, which Vitals “won” and was later taken over by Steward Health Care.

Despite years of resisting its release, all government departments asked by the NAO for a copy of the MOU claimed that it could not be found. On Tuesday, the Prime Minister said, after giving his government an ultimatum, that the MOU has again been ‘found’ and a copy passed onto the NAO. Both the Prime Minister and the NAO are refusing to publish it.

Notwithstanding the secrecy surrounding this document, The Shift has, over the years, amassed a surprising amount of information from multiple sources, and other documentation that sheds light on its contents and importance.

When was the MOU signed?

The MOU was signed on 10 October, 2014. The RfP for the concession was published on 27 March, 2015.

Who signed the MOU?

The parties to the MOU were then-Economy Minister Chris Cardona, on behalf of the Government of Malta, and Mohammed Shoaib (Walajahi), along with Shaukat Ali Chaudhry (Abdul Ghafoor), on behalf of Maltese company Pivot Holdings, as well as investors Ashok Rattehalli of US company AGMC and Mark Pawley, representing company Bluestone Special Situations 4 in the British Virgin Islands.

Pivot Holdings is owned by Shaukat Ali, his son Asad Ali and Dubai-based PPP advisor Mohammed Shoaib. AGMC is owned by Rattehalli, and Bluestone Special Situations 4 is, according to public information, owned by Pawley.

Excerpt from the Agreement signed between the investors in November 2014 referring to the MOU with the government

What did the MOU cover?

The MOU considered the government awarding the investors Gozo General Hospital on a long term concession, and requiring them to build premises for St Barts. The MOU set out the terms under which the government would award the project to the investors, including undertakings to assist with medical visas, as well as visas for medical staff.

The MOU also required entry into a final contract by a stipulated time frame.

What did the investors do next?

The original investors raised funds from other investors, on the basis of the MOU with the government.

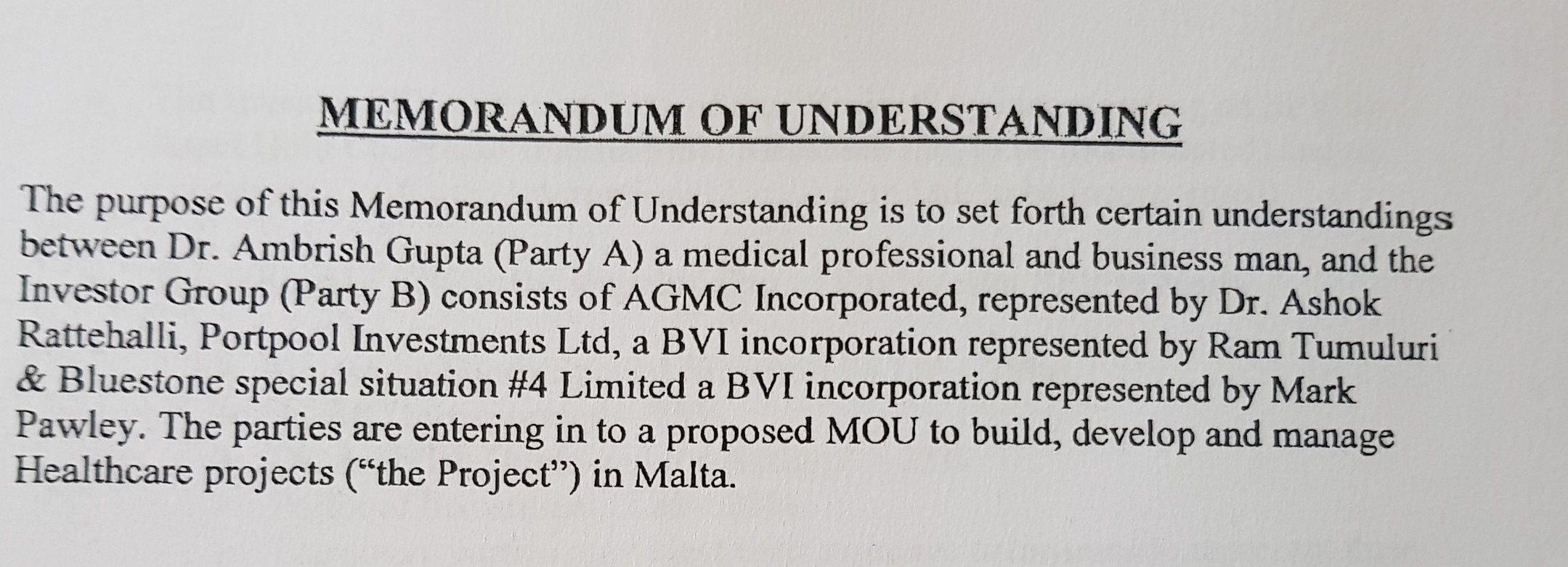

On 23 November, 2014, some of the investors, including Ram Tumuluri, signed an agreement with a new investor – Dr Ambrish Gupta. Under this agreement, the investors said they had signed an MOU with the government of Malta for a project involving building, developing and managing a “world class healthcare facility” in Gozo, and that Gupta was being added as a 25% shareholder. The investors also agreed that they needed to raise additional funding.

The agreement extensively describes the project covered by the MOU, and even includes how investors were offered the potential acquisition of St. Philips and St. Luke’s Hospital.

Those investors signing the MOU noted that they only owned 70% of the project, with the remaining 30% presumably owned by Pivot Holdings Ltd. They also agreed that they will establish a company between them that would own 70% of two other Maltese companies which will, in turn, own the concession.

The Memorandum of Understanding signed between the hidden investors referred to an agreement already signed with the Government of Malta including a detailed description of the project. This was months before the tender was even announced.

Were these companies ever set up?

Yes. In December 2014, Bluestone Investments Malta was set up. A company called Crossrange Holdings was also created in Malta, 70% owned by Bluestone Investments Malta and 30% owned by Pivot Holdings.

In addition, Crossrange Holdings set up the companies Gozo International Healthcare and Gozo International Medicare.

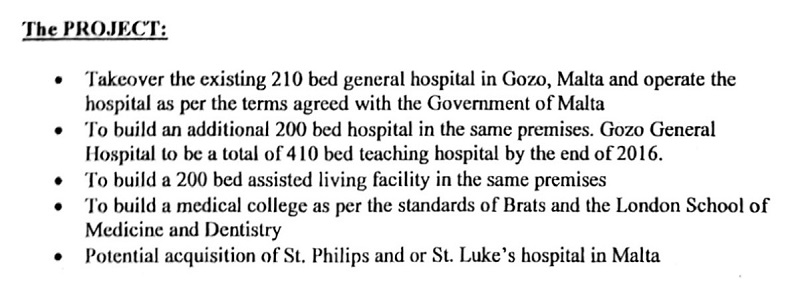

In January 2015, the investors signed yet another agreement, identifying Bluestone Investments Malta as the company in the original agreement, and noting that, notwithstanding anything in public documents, they secretly controlled and effectively owned Bluestone.

These companies lay abandoned, but Bluestone Investments Malta would go on to win the “tender” issued in March 2015 and establish the infamous Vitals Global Healthcare, in place of Gozo International Healthcare.

Shaukat Ali Abdul Ghafoor (left) with former Prime Minister Joseph Muscat’s Head of Security John Portelli (centre) at Tigne Point, Sliema.

Why wasn’t a tender properly issued in the first place?

It is unclear why the government signed an MOU with investors, only to later issue a tender for a similar project. Legal sources consulted by The Shift confirmed that a concession of this type required a public tender.

It is likely that the government, and possibly the investors, realised this and sought to remedy the “issue” by issuing a tender that only Bluestone could win.

In fact, when the RfP was issued in March 2015, the only valid bid was Bluestone’s, which went on to win. The NAO was highly critical about the process for the issuing of the RfP, as well as it being awarded to Bluestone.

But didn’t the government say that the MOU was for a different project?

The MOU mentions Gozo General Hospital as the subject of the “project” and the building of St. Bart’s medical school, both of which were included in the final RfP.

The final RfP also included Karin Grech, as well as St. Luke’s, which were not specifically mentioned in the MOU. But the investors knew, in their agreement dated four months before the RfP was published, that they could take control of the hospitals, even mentioning St. Luke’s hospital.

How do we know that the MOU and the later concession are linked?

There are a number of links between the MOU and the entities that would later win the concession.

The organisations that eventually won the concession was Bluestone Investments Malta, which went on to establish Vitals Global Healthcare. On paper, Bluestone appeared to be solely owned by Pawley but, in reality, the investors who signed the MOU, and others brought aboard by those investors, retained their beneficial interests.

The Shift has detailed how Shaukat Ali, Ram Tumuluri, Gupta and Rattehalli sought to retain their interests in Bluestone through a convoluted network of hidden private agreements, loans and even Jersey companies.

Even though the public register continued to only list Pawley as the owner, in practice the investors had agreed that this did not reflect reality, as the hidden agreements superseded anything in the company’s documents or public register.

Excerpt from an Agreement between the investors dated 7 January 2015. Here the investors identified Bluestone as the SPV that they co-owned in connection with the Hospitals project notwithstanding that the company documents said something else.

Perhaps the two most telling items linking the MOU to the final concession are Rattehalli’s court case and Gupta’s bank statement.

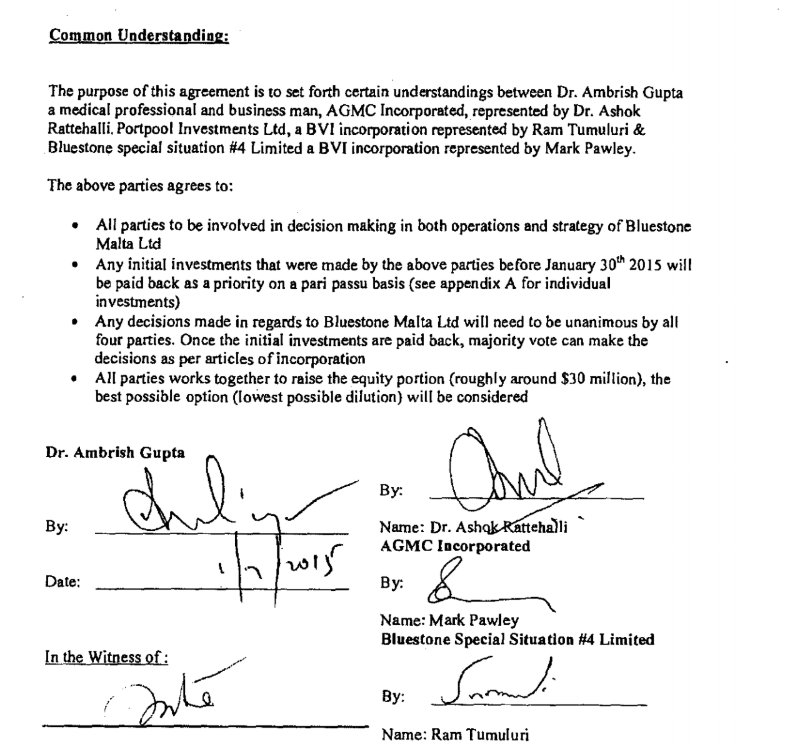

In the final hours before Vitals’ shares were transferred to Steward Health Care, in what amounted to a last minute bailout of the concession, Rattehalli, who was only listed in the hidden MOU, filed a court case.

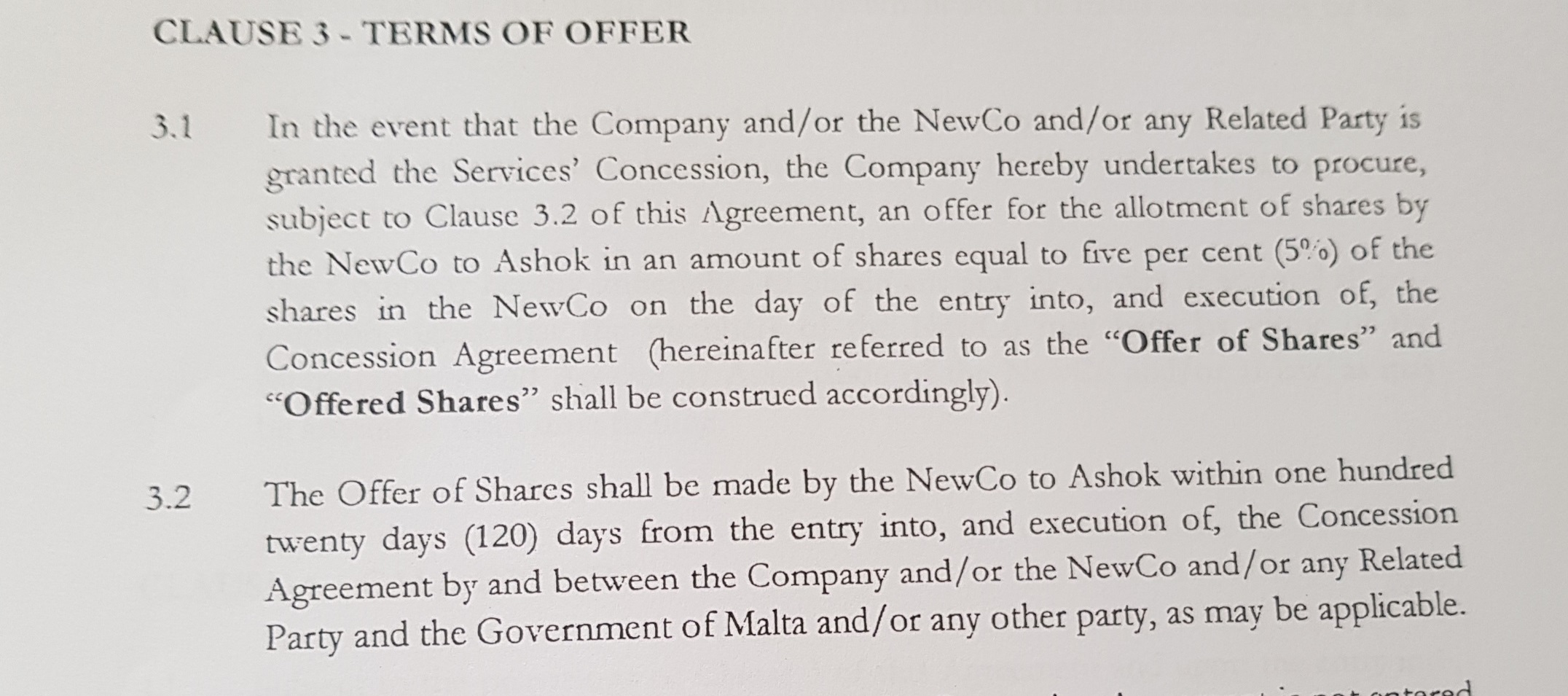

In court submissions, Rattehalli claimed he was owed 5% of the shares in Vitals and presented copies of the secret agreements. This last minute development risked derailing the transfer to Steward, but instead, Rattehalli was given 5% of the shares in a company owning a concession, valued at over €1 billion.

Rattehalli still holds these shares, alongside with Steward.

Excerpt from Ashok Rattehalli’s option agreement – a promise to buy – over shares in Vitals.

Gupta was one of the new investors brought on by the original group of investors in November 2014, on the basis of the MOU. Like Rattehalli, Gupta also safeguarded his hidden interest through loan and option agreements over shares in Bluestone and Vitals, which were later exposed when investors became worried about being cheated and filed court cases regarding the transfer to Steward.

These court filings were later settled by Bluestone or Steward out of court, in order to proceed with the transfer to Steward.

Unlike Rattehalli, Gupta’s hidden involvement would have been apparent at the time the RfP was issued, if appropriate due diligence had been carried out.

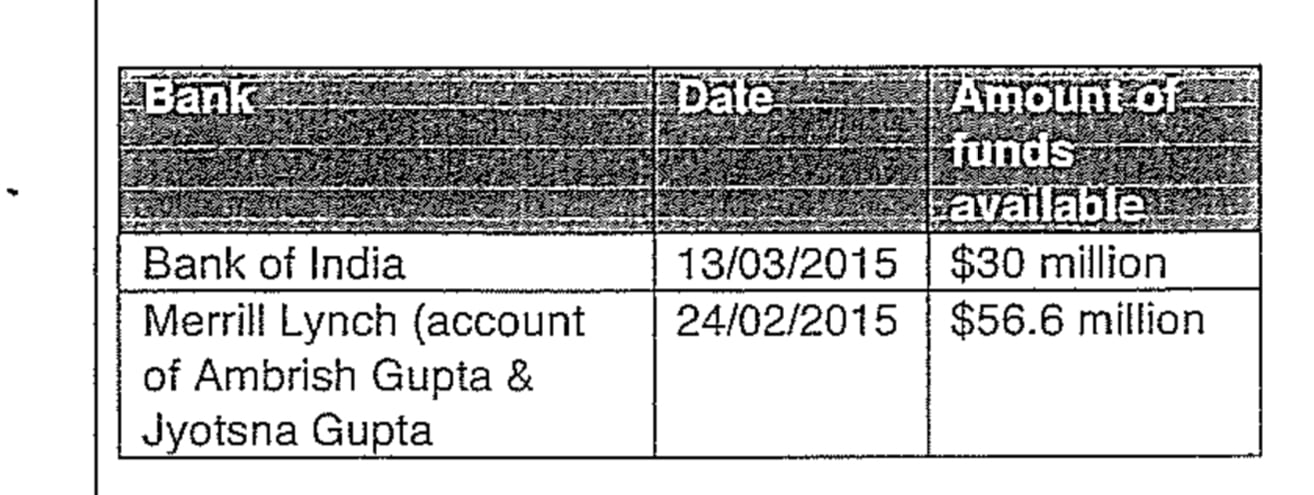

As part of the RfP submissions, bidders were required to file proof of having sufficient funds to develop the concession. Oddly, Bluestone filed a copy of Gupta’s personal bank statement. Gupta, at this point, was not listed anywhere in the ownership structure of Vitals / Bluestone (except through the secret agreement between the investors on the back of the MOU).

Excerpt from the Vitals Evaluation Report. Bluestone submitted a copy of Dr Ambrish Gupta and his wife’s bank statement as evidence of sufficiently deep pockets without Gupta having a formal role other than through the MOU and related hidden contracts.