Three months ago, The Shift ran the first instalment of a long running investigation into the murky Enemalta deal in Montenegro. The first instalment highlighted how the Mozura Wind Farm project almost fell through in 2014 when Fersa Energias Renovables, the previous owners, fought with its fixers and held back bribe payments.

Tellingly, the project was brought back on track when, as an intermediary told The Shift, “those in the government (of Montenegro) found the people of their kind (in Malta) who they could do business with and split the proceeds”.

Back then, our findings were met with a wall of silence.

Building on The Shift’s research, Reuters tracked down the owner of one of the shell companies involved in the deal. They also found payments totalling just over €7 million to 17 Black Ltd, the UAE company owned by Yorgen Fenech, the Tumas Group heir charged with conspiring to murder journalist Daphne Caruana Galizia.

In a leaked email from 2015 that formed part of the Panama Papers, Nexia BT had indicated 17 Black as a “client” of former Chief of Staff Keith Schembri and then Energy Minister Konrad Mizzi’s Panama companies which were set to receive payments totalling around $2 million a year.

The payments to 17 Black in connection with the wind farm appear to have been funded by the startling difference in price between:

- The €2.6 million paid by Cifidex Ltd, a Seychelles shell company, to Fersa for the project, and

- The €10.3m paid by Enemalta to Cifidex for that same project, only two weeks later.

All concerned, as usual, deny any wrongdoing.

The latest to join the fray of denials is Enemalta which released a long statement on Sunday afternoon through a Facebook post.

Enemalta’s statement – smoke and mirrors

Enemalta has a lousy track record with statements. Six months ago, The Shift ran another investigation, this time relating to Streamcast, and Enemalta also released a statement playing down any claims. Yet, six months later, Enemalta was in Court trying to recover some €500,000 amidst the €7.8 million mountain of debt left behind by the questionable people behind Streamcast.

So, we thought their statement on Montenegro deserved fact-checking too. Here’s how their claims weigh up:

A. “Enemalta was completely unaware of any alleged transactions between Cifidex and 17 Black, it has nonetheless commissioned an internal investigation and also filed a report with the police to investigate the matter.”

Enemalta denies any knowledge of transactions between Cifidex and 17 Black (we’ll keep this denial in mind for the future) and confirm having:

(a) commissioned an internal investigation and

(b) filed a police report on the matter.

Curiously, given Enemalta’s subsequent claims that, in essence, there was nothing untoward, Enemalta state that they filed a police report. Police reports are only filed to investigate crimes, thus implicitly acknowledging that a crime may have been committed. It is itself a crime to file a false police report.

Former Energy Minister Konrad Mizzi in Montenegro, flanked by lawyer Aron Mifsud Bonnici, with Montenegrin Economy Minister Vladimir Kavaric.

B. “…the portion of the purchase price payable by Enemalta amounted to €2.977 million, which is nowhere near the €10.3 million as quoted in section (sic) of the media, with the difference between the €3.5 million actually paid and the €2.977 million which was payable, having been reimbursed to Enemalta by the other consortium members.”

Here Enemalta is referring to the fact that, after having bought the Mozura wind farm for a price of €10.3 million (i.e. overpaying by €7.7 million), Enemalta then went on to transfer the project to a consortium led by the Chinese State.

Enemalta put up a €1.5 million guarantee and paid a €3.5 million deposit towards the final price of €10.3 million.

The exact shareholding percentages of the consortium are not particularly relevant but generally this is what the consortium looks like according to public records:

- State-owned Shanghai Electric (SEP) (44.1% indirectly but controlling 70% of the consortium),

- Enemalta (28.9% direct and indirect, but 18.9% is controlled by SEP, besides SEP being itself a shareholder in Enemalta),

- A Guernsey company called Vestigo Clean Energy I Ltd (18%)

- A Hong Kong company called Envision Energy International Limited (9%).

We know Enemalta agreed to pay €10.3 million for the wind farm because Enemalta’s own financial statements say this and their Facebook statement later confirms that this was, in fact, the price agreed.

Taking this statement at face value, Enemalta is saying that, yes, the price was €10.3 million but we “only” paid €2.977 million from that since the rest was to be borne by our partners in the consortium.

This is disingenuous.

Even if the flawed claim that essentially “others got cheated” is briefly entertained, Enemalta still got swindled for its own share – that is, it paid €2.977 million for something worth €806,000 two weeks earlier.

C. “Apart from this and as identified in the 2017 audited accounts, when Enemalta sold 90% of its shareholding to the other consortium members it also made a profit of €811,000 on such sale.”

This is another flawed claim where Enemalta is essentially saying “others got cheated”, not us. Again, the €811,000 profit on paper that Enemalta is claiming to have made doesn’t cover much of:

- The €2.171 million overpaid;

- The financing costs of the millions that Enemalta put up for two years until the consortium took on the project; and

- The €1.5 million guarantee that Enemalta was obliged to provide to the Montenegro State (more below).

D. “From the start of negotiations the consortium which Enemalta formed part of had been given the opportunity to acquire shares in the Montenegro wind farm from Cifidex and not from Fersa”

Here is where the playing around happens.

Enemalta claims that it started hunting for projects to invest in back in March 2014 and that it was never given the opportunity to cut out the middleman (and save €7.7 million) since, at the time, “Cifidex’s negotiations with Fersa were already at an advanced stage”.

Further, Enemalta claims that while Cifidex could enter into binding agreements in February 2015, Enemalta could only do so after “successful completion of due diligence on the project”.

Unfortunately for Enemalta, the facts show otherwise.

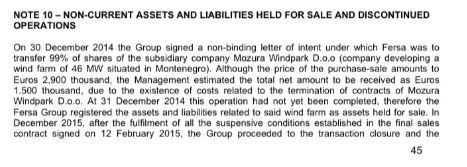

As regards the timing of negotiations, we know from press reports that Fersa were effectively pushed out by the Montenegrin government in July 2014. We also know from Fersa’s accounts and other public records that Fersa commenced negotiations to dispose of the wind farm in December 2014 (it signed a “non-binding” letter of intent) and signed a promise of sale with Cifidex in February 2015.

An extract from Fersa’s 2015 financial statements.

In September 2014, Enemalta established a subsidiary (since abandoned) called International Clean Energy Ltd – this entity would then go on to sign its own promise of purchase with Cifidex.

Konrad Mizzi’s visits to Montenegro also commence in September 2014. Between the time Fersa knew they were being pushed out of the project and Enemalta buying it, Konrad Mizzi visited Montenegro seven times, twice before Fersa even said they had started talks to sell the project.

Perhaps even more tellingly, on 26 February 2015, just two weeks after signing a promise of sale agreement with Cifidex, Fersa filed a request with the Montenegro government to transfer the lease – it named Enemalta as the recipient:

This is an excerpt from a Montenegro government report in June 2015: “On February 26, this year [2015], the Ministry of Economy received a letter from the investor [Fersa] by which it expressed interest in transferring rights and obligations from the contract to the new tenant. The company to which the transfer of the contract was proposed is the company “Enemalta corporation” from Malta, which has expressed its readiness to enter the project by taking over all obligations from it.”

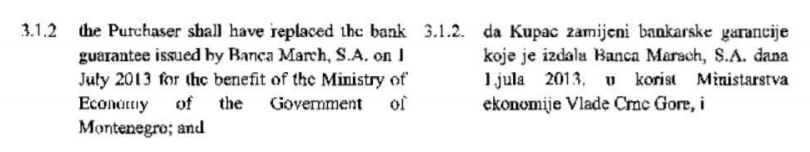

As regards the claim that Enemalta needed to carry out due diligence before committing and that Cifidex were able to sign before, the original share purchase agreement signed by Cifidex and Fersa, seen by The Shift, was subject to a number of conditions precedent.

In fact, Cifidex only actually bought the shares in the project in December 2015, 10 full months after signing the promise of sale.

Cifidex was obliged to replace the guarantee that Fersa provided to the government. In fact Enemalta provided this.

One of these conditions was providing of a new guarantee to the Montenegrin government to release that provided by Fersa, which in fact Enemalta provided in November 2015.

Disgraced former Prime Minister Joseph Muscat (centre) with then Energy Minister Joe Mizzi in Montenegro.

E. “Though preliminary agreements had been entered into in February 2015, the consortium only entered into agreements which were not subject to further due diligence in October 2015.”

Here Enemalta is admitting that it signed “preliminary agreements” in February 2015, which is only days after Cifidex signed a promise of sale agreement with Fersa for those same shares.

If Fersa was already aware of Enemalta’s firm interest, was evidently happy with it and, in fact, went on to ask the Montenegro government to transfer to Enemalta rather than Cifidex, why did Enemalta allow Fersa to transfer the shares to Cifidex first, with them taking a €7.7 million cut?

F. “Extensive due diligence of the project and its financial viability were carried out by Shanghai Electric Power (SEP) … The price was eventually agreed to by all four members of the consortium, and not by Enemalta on its own.”

Here Enemalta is passing on the buck. It claims that any due diligence was conducted by SEP and that Enemalta only reviewed the reports by SEP and its advisors before agreeing to be one of the investors in the project.

Although this order of things is perhaps brought into question by Konrad Mizzi’s frequent gallivanting to Montenegro, we do wonder why Enemalta, which it seems was rather central to the deal, didn’t commission its own due diligence.

The note that the price was agreed to by all members, unfortunately, confirms the impression that Enemalta is pulling the “others were duped more than us” card.

G. “…between February 2015 (the date when Cifidex entered into agreement/s to acquire the shares from Fersa), and December 2015 (the date when Enemalta acquired the shares from Cifidex) Cifidex also undertook various other liabilities and obligations which had been incurred by Fersa … thereby contributing to the mentioned purchase price by the consortium.”

Here Enemalta tries, unsuccessfully, to justify the €7.7 million jump in price between the €2.6 million paid by Cifidex in December 2015 to buy the shares in the project, and the €10.3 million agreed to be paid by Enemalta also in December 2015 for the same project.

Enemalta seeks to justify this jump in price by:

- Mentioning that Cifidex had to pay a wind measurement fee, which The Shift is reliably informed was barely over €1.5 million;

- Referring to the payment by Cifidex of certain fees and payments due to Celebic d.o.o., the local fixers in Montenegro who were to pass on the bribes, and others.

The project went from an “almost dead” status (when Fersa who fell out of favour) to a “ready to build” status – in other words, Cifidex helped grease the wheels and paid what Fersa was refusing to pay. Hardly encouraging.

Fersa’s 2015 audited accounts note that although the sale price was €2.6 million it only got €1.5 million since there were certain costs outstanding relating to the termination of contracts.

There’s more. While Fersa’s contract with Cifidex says that the purchase price was €2.6 million, in actual fact Fersa only received €1.5 million because of the existence of certain costs. It is not yet clear whether these include the same costs that Enemalta is claiming justify the €7.7 million jump in price.

H. “…a guaranteed equity internal rate of return on this investment, and this was eventually set at 9.4% for Enemalta’s benefit. The guaranteed return was committed to by Shanghai Electric Power (Malta) as the majority investor and Envision Energy.”

The first we heard of this “9.4% return” was from Konrad Mizzi’s “I did nothing wrong” Facebook post mere hours after the Reuters’ article went online.

Besides being unclear whether that % return is even annual, and without delving into the well known misleading nature of “internal rates of return”, does a promised rate of return on investment really justify the evident stench emanating from this deal?