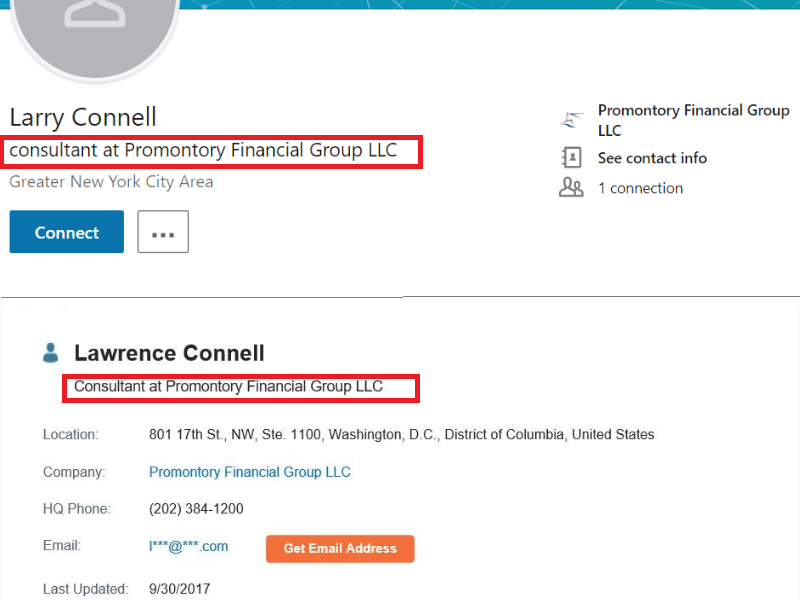

Lawrence Connell, appointed by the MFSA to take charge of all the assets of Pilatus Bank after its chairman Ali Sadr Hashemi Nejad was arrested in the US, was also a consultant for the global firm that received a direct order of €345,000 from the Finance Ministry only a few months later.

Connell was appointed administrator of Pilatus Bank in March last year. He kept a low profile, refusing to answer questions from the press on how long the process of winding down the bank would take, or the amount of deposits still held at the former bank based at Ta’ Xbiex.

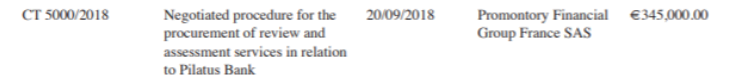

Yet, six months later, a global firm for which he acts as a consultant – Promontory Financial Group – was given a direct order of €345,000 on the case Connell was involved with in Malta. The direct order was for the “review and assessment services” in relation to Pilatus Bank.

The notice in the government gazette, February 2019.

The Shift News reported the direct order granted on 20 September last year, and its cost to taxpayers as a result of government inaction on the bank. The direct order was only announced in the government gazette this month.

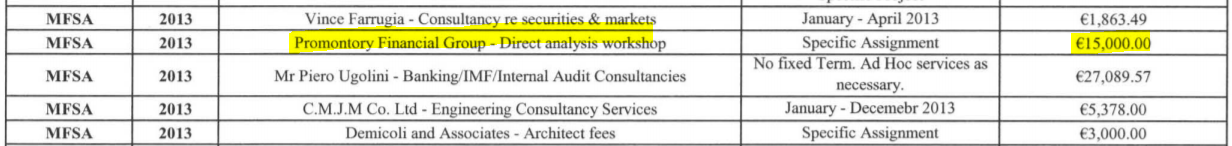

Promontory Financial Group first featured in direct order lists by the MFSA in 2013, following which, the MFSA has increasingly used its services for regulatory support as well as in relation to sanctions and prevention of money laundering.

Government gazette listing of direct orders, 2013.

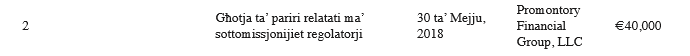

As the MFSA increasingly came under scrutiny, it also engaged Promontory to carry out a review of its supervisory processes in 2017/2018:

In May 2018, the FIAU also used Promontory’s services in the context of regulatory submissions, presumably relating to the EBA’s scrutiny in relation to its handling of Pilatus bank.

The Maltese government has repeatedly declined to provide details of the entities that carried out due diligence in relation to Ali Sadr Hashemi Nejad and Pilatus Bank back in 2013 when it was in the process of being authorised, citing sensitivity.

In the bio provided to the media upon his appointment, Connell was referred to as a US financial regulator, listing his experience with different banking bodies and firms, but there was no mention of his role with the Promontory Financial Group, despite this being the top role he lists in his various profiles on social media.

The EBA had stated it had “significant concerns” over the MFSA’s handling of authorisation and supervisory practices relating to Pilatus Bank. The licence was eventually revoked.

To date, no further information on the investigation, or any findings have come to light or been made public.

The company benefiting from the latest direct order was Promontory Financial Group France, a financial consulting firm tasked with giving an impartial insight into misconduct, money laundering and sanctions violations.

In 2015, the firm was suspended on suspicion of helping to obscure misconduct carried out by Standard Chartered bank which was suspected of processing billions of dollars on behalf of Iran, according to the New York Times.

The firm was accused in the US of sanitising the report to decrease the scope of the illicit transactions, and it has since been suggested that murky individuals used the firm because they were considered a “safe pair of hands”.

Read: The cost of government inaction on Pilatus Bank

Promontory Financial Group settled their ‘dispute’ with the regulator including the payment of a US$15 million “settlement fee”, and it was later bought out by IBM in 2016.

The owner and chairman of Pilatus Bank, Ali Sadr Hashemi Nejad was arrested in the US in 2018 and is facing up to 125 years in US prison on charges of fraud and evading US sanctions.

Promontory Financial was also engaged in drafting a report by Denmark’s largest bank, Danske Bank, embroiled in the scandal of laundering $30 billion of Russian and ex-Soviet money through its Estonian branch in a single year, according to the Financial Times.