In collaboration with Nina Fargahi and Sylke Gruhnwald for Swiss digital magazine Republik.

Pilatus Bank owner Ali Sadr Hasheminejad used companies in Switzerland hidden behind an international trustee called Maygold whose managing director, Raphael Wyss, also served as managing director at Henley Trust, according to the Swiss company register.

Ali Sadr’s companies in Switzerland are all registered at Maygold, which calls itself an international trustee. Wyss did not want to comment on the arrest of Ali Sadr in the US last month on charges of money-laundering and evading US sanctions.

The group has three divisions, operating via more than 20 offices worldwide: Henley & Partners, which focuses on residence/citizenship planning and government advisory; Henley Estates, which focuses on high-end real-estate for private clients; and Henley Trust, which provides fiduciary and tax planning services for private clients and family owned businesses.

Ali Sadr received a banking license for the Pilatus Bank in January 2014, while Henley and Partners also received approval for Malta’s cash for passport programme in the same month.

Ali Sadr used St Kitts and Nevis passports acquired through Henley and Partners to incorporate two companies — Stratus International Contracting in Turkey, and Clarity Trade and Finance in Switzerland.

The financing for Pilatus Bank in Malta came, at least in part, from Swiss Perse Finance registered in Zug, an affluent municipality in Switzerland, investigations by the international team of journalists revealed.

Ali Sadr is now charged with funnelling more than $115 million paid under a Venezuelan construction contract through the US financial system. If convicted, Ali Sadr could face a sentence of up to 125 years in prison. He was denied bail.

Financial Times reported on Thursday that between April 2011 and November 2013 about 15 payments worth about $115m were made by the PDVSA, the State-owned Venezuelan oil company, to Stratus International Contracting and Clarity Trade and Finance.

The dollar payments were sent to bank accounts Stratus and Clarity Trade and Finance held at banks including Zurich-based Hyposwiss Private Bank Ltd and cleared through US banks including JP Morgan. Other banks were also used.

Most of the funds received into the bank accounts of Clarity and Stratus were then transferred to a company in the British Virgin Islands incorporated by Sadr and others. US prosecutors said the ultimate beneficiary of the payments were Iranian individuals and entities, according to the Financial Times.

Pilatus Bank was subject to an investigation by Malta’s anti-money laundering agency, the FIAU, which concluded that the bank showed a “glaring, possibly deliberate disregard” for money-laundering controls.

Christian Kalin left his post as vice chairman of Henley Trust in 2013. He is now the chairmain of Henley and Partners Group.

The link between Henley and Partners and Ali Sadr was made clear by slain journalist Daphne Caruana Galizia, who connected the dots between the passport scheme, Pilatus Bank and the Maltese government.

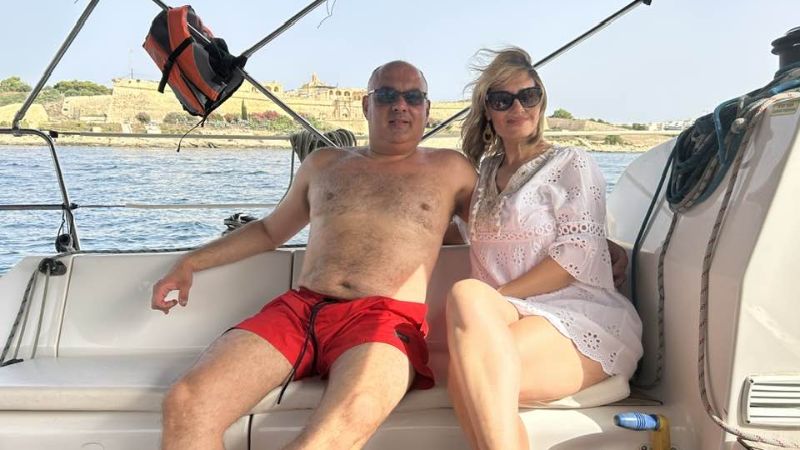

Henley and Partners chairman Christian Kälin confirmed that he has known Ali Sadr for several years, in a hearing with MEPs investigating the rule of law in Malta. Ali Sadr was invited to the 20th anniversary of Kälin and his wife in Switzerland, according to Caruana Galizia.

“Hasheminejad bought a St Kitts & Nevis passport from Kalin’s outfit in 2009. Though Kalin claimed, when I asked him point blank, not to have any particularly special relationship with Pilatus Bank, the fact remains that he is very close to Hasheminejad. Kalin and his wife even invited Hasheminejad and his wife to their 20th wedding anniversary party in Switzerland, which is a good indicator of the nature of their relationship – not distant or merely professional at all,” she wrote.

Note: Henley and Partners have denied the assertions made in this article.