The validity of the public procurement process on the hospitals concession granted to Vitals Global Healthcare and transferred to Steward Healthcare on Friday is open to question, according to lawyers who spoke to The Shift News.

The Malta hospitals concession awarded to Vitals less than two years ago was effectively transferred to Steward on 16 February after one of the initial investors – Ashok Rattehalli – withdrew legal action.

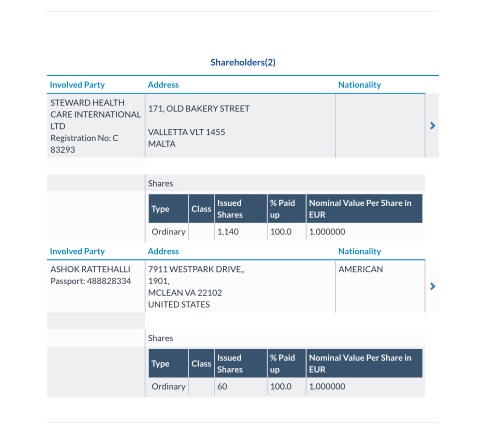

The documents filed at the Registry of Companies on Monday show that, after withdrawing the legal action that risked stalling the transfer to Steward, Rattehalli got his 5% cut (60 shares) in Vitals (95% was transferred to Steward).

By acceding to Rattehalli’s demands for 5% of the shares in Vitals, Bluestone Investments (the company behind the Vitals concession) and Steward (receiving the concession under the same CEO Armin Ernst) have in not so many words acknowledged and accepted that this tender was tainted from the very beginning.

As noted in Ashok Rattehalli’s claim in documents submitted to Court, the reason why he got the 5% is because “he was one of the original promoters of a group of persons/entities which, from a technical, administrative and financial perspective, together formulated a bid for the management and administration of a number of hospitals in the Maltese Islands”.

Yet this was five months before it was known that the government would issue a call for proposals.

The documents make it clear the hidden investors knew exactly what they were going to get. The agreement they signed among themselves included details that were similar to the call the government eventually made. VGH was negotiating with other countries based on the strength of their hidden agreement with the government even when the contract had not yet come into effect.

By accepting to grant him those shares, the integrity of the public procurement process is probably open to question, lawyers said.

Evidence presented in court confirms that the same investors that signed that secret deal:

- knew they would be operating the hospitals (before a call was issued);

- had agreed among themselves to manage Bluestone Investments Ltd as though they were involved as directors; and

- also agreed among themselves that Bluestone Investments Ltd was beneficially owned by them equally (even if the shareholders register did not say that).

The reason why Rattehalli was granted this cut is, as explained by Rattehalli in his Court submissions, simply because he was involved since the very beginning – since October 2014, when the secret investors signed their hidden deal with the government.

A lawyer who spoke to The Shift News summed it up: “It will be very hard to argue that EU public procurement rules were duly followed in a bid where (a) investors kept their material interests in the bidder hidden, and (b) they are substantially the same persons that signed an MOU with the government essentially promising them the concession before a call was made public”.

Referring to government claims that the agreements signed before the public call was made were unrelated, the lawyer added: “By acceding to Rattehalli’s claim, who it appears was a signatory of the original MOU and whose interest was kept hidden, and granting him his 5%, that argument is substantially weakened.”

Micro-bloggers on Twitter were perhaps more direct: “What few might have realised is that [the] very same reason why Rattehalli now got his 5% is the exact same reason why the concession should be revoked,” according to a Twitter post by BugM which contained documents that substantiate the views expressed by lawyers who spoke to The Shift News.

“Rattehalli justified his entitlement to 5% or 60 shares since he was involved in obtaining an MOU from the government pre-tender, signed an agreement with the other secret investors pre-tender and signed a hidden share option agreement,” the tweet said.

The concession got transferred to Steward Healthcare after supply contracts were put in place, meaning the men behind the secret deal will continue to profit for years to come despite failing to deliver. Taxpayers have forked out over €50 million to VGH since 2016, yet no new service has been offered and none of the hospitals refurbished. The men behind the secret deal with the government also leave a trail of debt behind.

The Opposition has sued the government, arguing VGH’s failure to adhere to its contractual obligations means the three hospitals should be re-nationalised.

To comment on this story or anything else you have seen on The Shift News, please head over to our Facebook page or message us on Twitter.