Four months before the government had issued the Request for Proposals for the Malta hospitals concession, the investors who eventually won the bid had already signed an agreement among themselves with very specific details related to the concession.

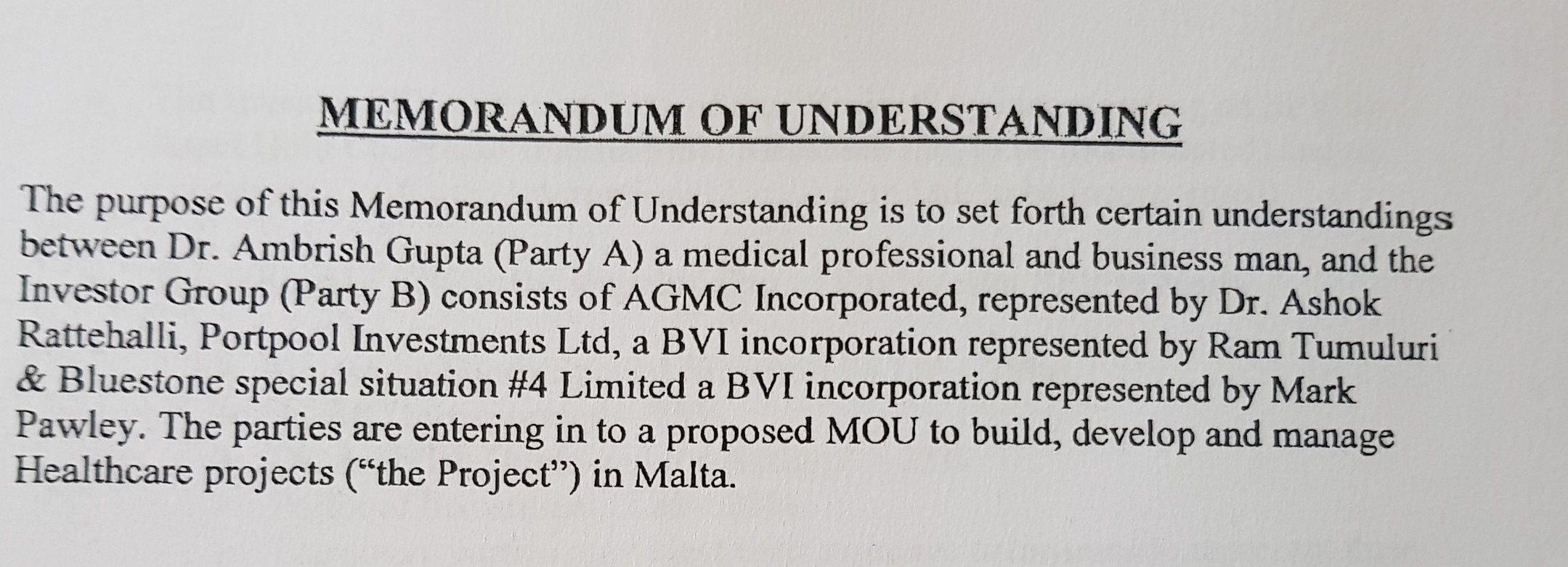

In November 2014, a Memorandum of Understanding (MoU) was signed between “on the one hand Dr Ambrish Gupta and on the other hand Dr Ashok Rattehalli in respect of AGMC Inc (a US company owned by Rattehalli), Sri Ram Tumuluri in respect of Portpool Investments Limited (a BVI company) and Mark Pawley in respect of Bluestone Special Situation #4 Limited (the BVI company that purportedly won the bid),” according to court documents.

The investors in Vitals Global Healthcare were not known up to this point, since the company that won the bid for the hospitals concession was, on paper, owned by a company based in the British Virgin Islands.

The documents were submitted in court by Rattehalli on 19 December when he tried to stop the controversial sale of the Malta hospital concession to Steward Healthcare, which was announced last month.

The MoU among the investors was signed a month after the government signed another secret MoU with the investors.

The Request for Proposals by the government was issued in March 2015, and yet in November 2014 the investors’ agreement states that Rattehalli, Tumuluri and Pawley through their respective companies have “entered into an agreement with the Government of Malta to build, develop and manage [a] world class healthcare facility in Gozo.”

The MoU additionally notes that Rattehalli, Tumuluri and Pawley own “70% equity in the project” indicating that further original investor(s) hold the 30%.

This raises the question of who owns the other 30% and whether that is the going rate for commissions for enablers hidden under another complex web of offshore companies?

Rattehalli’s submission to court proves that the government’s secretive agreement with the investors was signed five months before the Request for Proposals for the hospital concession was issued in March 2015, confirming doubts that the deal was already sealed for the investors behind VGH.

The MoU among the investors includes very specific details at a time when the public was not even aware of the government’s intentions with the hospitals’ concession to third parties.

The agreement includes a detailed description of the project including taking over the existing 210 bed general hospital in Gozo and operate the hospital “as per the terms agreed with the Government of Malta”, building an additional 200 bed hospital in the same premises, building a 200-bed assisted living facility in the same premises, building a medical college as per the standards of St Barts and the potential acquisition of St. Philips and/or St Luke’s hospital.

A subsequent amendment to the investors’ agreement also states that the parties agreed to work collectively to raise the equity and debt funds to complete the project, showing they did not have the necessary investment required.

The MoU also lists how the ownership of the company that controls 70% of the project will be split (either directly or through nominees): Bluestone SS4 (25%), AGMC (25%), Ambrish Gupta (25%) and Portpool (25%).

The MoU additionally includes two familiar company names “Gozo International Medicare Ltd” and “Gozo International Healthcare Ltd” as being intended as a company to hold the Project’s assets and the other for its operations.

Appendix 1 to the MoU includes anticipated pre-project costs: $500,000 with $160,000 being “immediate”, including $30,000 for “local Malta consulting” and $50,000 for “travel and entertainment”.

Under the MoU Gupta agreed to lend Bluestone SS4, AGMC and Portpool $300,000 (later increased) to cover the initial expenses most of which are “consultancy fees”.

The Vitals deal was controversial from the start, since the bid was won by individuals with no experience in healthcare management compounded by the reputation of Tumuluri – the only face representing the deal in Malta – as a fraudster.

Slain journalist Daphne Caruana Galizia had said in May 2015 that this was “another fixed deal”.

In September 2015 the government granted VGH a 30-year concession agreement (with the option to extend to 99 years) to operate the Gozo, St Luke’s and Karen Grech hospitals in a public-private partnership.

VGH had agreed to invest some €220 million to upgrade the three hospitals and the government agreed to pay the company some €70 million a year (€2.1 billion over the 30-year period) to provide hospital beds to the State. Little is known about how much VGH actually put into the hospitals to date.

The government agreed to cover the salaries of the hospital employees, pay VGH €1.2 million a year (€36 million over 30 years) for the medical school in Gozo, pay them €1 million a year (€30 million over 30 years) for their air ambulance service, and pay them unspecified millions for medicinal, surgical and pharmaceutical services.

The local parent company behind Vitals Global Healthcare (VGH) – Bluestone Investments Malta Limited – has failed to file any audited accounts since its incorporation in 2014, according to the Malta Financial Services Authority records.

The Sunday Times of Malta reported last month the government sold the contents of the three hospitals to VGH for just €1.

Only 21 months since the group won the concession and despite their failure in meeting stipulated project deadlines, the group now intends to sell the concession to third parties.