Henley & Partners spent up to €300,000 last year on lobbying efforts on the main EU initiatives, polices and laws relating to citizenship and immigration policies and their application in Member States, such as Malta, according to the EU’s transparency register.

The transparency register also discloses that Henley & Partners has two full time employees involved in lobbying and three part-timers (25% of their time).

Source: Transparency Register.

An additional €10,000 were spent by the Investment Migration Council (IMC), an association for investor immigration and citizenship by investment of which Henley & Partners is a founding member and on which a number of its employees sit as members.

Henley & Partners Chairman Christian Kälin is one of the members of the IMC’s governing board.

The IMC’s specific activity in the register is listed as an “interest in participating in the debate surrounding residency and citizenship by investment programmes,” and “to reach out to MEPs [and] educating them” on these programmes.

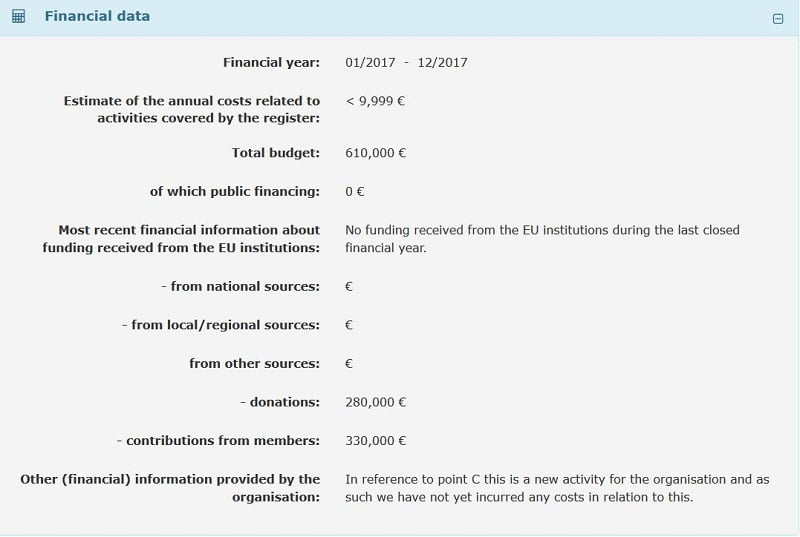

The IMC budget for its lobbying work was in fact much higher than the €10,000 spent. Its listed budget in the EU’s transparency register is €610,000.

It received €280,000 in donations and a further €330,000 from members, according to the transparency register.

Source: Transparency Register.

The IMC was set up in 2014. Apart from Henley & Partners, other founding members include London law firm Mishcon de Reya Solicitors accused of having “threatened and harassed” and seeking “to financially cripple” assassinated journalist Daphne Caruana Galizia, by her three sons.

A month before her death in a car bomb a few metres outside her home, Caruana Galizia had written: “Mischon de Reya…is the very same London law firm which Henley & Partners, in association with Malta’s crooked Prime Minister and his bent chief of staff, uses to intimidate journalists and other critics into silence”.

The international audit firm KPMG was also a founding member. The firm was involved in helping the now defunct Pilatus Bank get its license in Malta. The bank’s chairman Ali Sadr Hasheminejad was arrested in the US and faces up to 125 years in jail on charges of evading US sanctions.

KPMG audited the bank and it was commissioned to prepare a counter report for the bank against suspicions of money laundering flagged by the Financial Intelligence Analysis Unit (FIAU). This is documented in a number of reports, including that by MEPs investigating the rule of law in Malta and the firm’s audit of the bank.

Industry lobbying is a major source of controversy generally, and in this particular industry specific concerns have been raised.

The European Commission’s report on ‘golden visas’ published recently was the first initiative of its kind, looking into the implementation of cash-for-passport schemes in Member States. It delivered a stern warning to Member States Malta, Bulgaria and Cyprus that these programmes had opened Europe to money laundering, tax evasion and organised crime. Yet, the report stopped short of making its full demands to address those concerns.

The Organised Crime and Reporting Project (OCCRP) revealed last week that the final report on ‘golden visas’ published by the European Commission had in fact removed a number of recommendations and demands on the industry and Member States, listing the discrepancies between the original draft and the one actually published.

The Commission’s report notes that, “Henley & Partners employ two full-time lobbyists in Brussels, in addition to holding a membership in the International Migration Council (IMC), a citizenship-by-investment association and lobbying group”.

MEP Ana Gomes had warned of the citizenship industry’s lobbying efforts: “There are people paid to defend the system and with an interest in defending the system…They have a lot at stake. They have ways to lobby and eliminate what would be more damaging from their point of view.”

The European Commission would not comment on the changes made in the report before publication, while both Henley & Partners and the IMC denied any involvement referring to “the near complete absence of genuine engagement”.

Henley & Partners said the report was “seriously misguided and reflected an inherent lack of understanding of how the investment migration industry actually operated, and of the rigorous due diligence and other know-your-client processes and protections in place to prevent any abuse or criminal activity”.

The firm said it had invested in best practices and “the highest levels of due diligence”. Combined with the measures by governments, “the threats mentioned in the report become largely redundant”.

The firm attributed abuse of the system to “unqualified or rogue actors”.

The global cash-for-passports industry is worth over $3 billion dollars, and Henley & Partners is one of the biggest players in the world.

Henley & Partners said: “To suggest that [the] IMC is a marketing and lobbying tool for the industry, specifically Henley & Partners, is untenable”.

Questions sent to the IMC remained unanswered.