Gozitan developer Joseph Portelli and his two main business partners, Mark Agius, known as Ta’ Dirjanu, and beach concessionaire turned developer Daniel Refalo, are asking the public to lend them a massive €50 million, partly to pay back millions in outstanding loans from Bank of Valletta and Fim Bank.

Following a restructuring exercise of their various companies, consisting mainly of recent developments of blocks of apartments all over the country, the three partners issued a €50 million bond with a coupon of 5.4% under the name of Excel Finance Plc.

The financial vehicle is headed by Albert Frendo, who was, until a few months ago, one of the top executives of the Bank of Valletta.

The bond’s prospectus shows that €25 million of the bond’s proceeds will go directly to pay the three businessmen’s outstanding loans with Fim Bank (€14 million) and Bank of Valetta (€11 million).

The rest will finance various ongoing construction projects across the island, mostly more blocks of apartments.

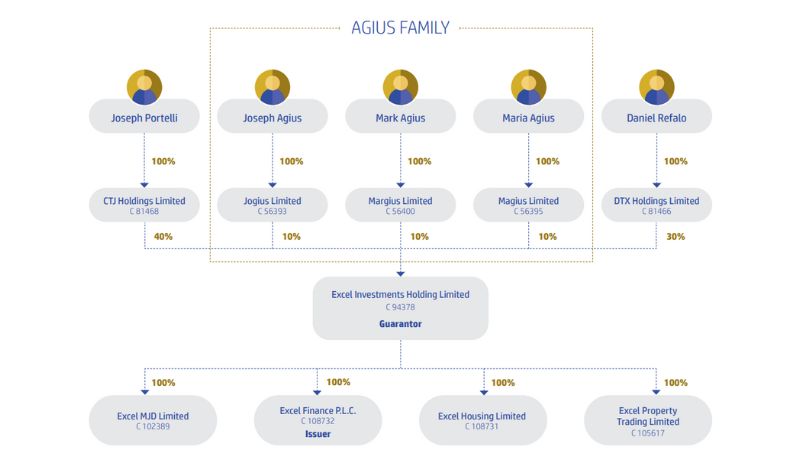

The new web of companies after a restructuring exercise.

The prospectus shows that the three businessmen, all with close connections to the ruling Labour Party, have concluded negotiations with the government over the past months to lease dozens of apartments to be used for social housing by the Housing Authority.

The blocks, comprising 184 units, are mainly in Gozo, where the need for social housing units is very low.

The prospectus does not say how many apartments from these blocks were leased to the government. However, it describes the blocks of flats as a fixed-guarantee to the bond issue, as they are tied to a 10-year lease with the government.

Industry sources said that while government rental income is generally lower than expected from the commercial market under standard terms, Portelli’s leasing of all these units to the Housing Authority indicates difficulty in selling or leasing these blocks in the current market.

Portelli, Agius, and Refalo are known to have strong connections with the government, and many of their controversial projects were often still approved by the Planning Authority despite opposition from stakeholders, including ERA and others.

In some instances, the court revoked permits issued to the Portelli clan by the PA and declared them irregular.

Before the 2022 general elections, Portelli organised a fundraising dinner for Prime Minister Robert Abela at Ta’ French restaurant in Gozo, during which many contractors contributed to the PL’s electoral campaign.

This is the second time Portelli has issued bonds to settle massive loans involving his construction projects in a few months.

Only last summer, through a different company, Portelli managed to secure a €20 million bond from the public to help repay some of his outstanding loans with Bank of Valletta regarding the Mercury Towers project.

Through Mercury Projects Finance PLC, the new €20 million injection was used to cover a €5 million loan due to BOV by the end of this year, only a part of €87 million in loans issued by BOV to Portelli for the Mercury project, with different maturity dates over the next few years.

In addition, Portelli also owed approximately €73 million in outstanding loans through bonds issued in recent years to fund the project.

Regarding Mercury Towers, it is estimated that Portelli pays around €4 million in interest annually to cover his outstanding loans.

Ilni nghid grazzi shift! Hemm blokkok Ghawdex ta dirjanu w Portelli li krihom l gvern biex ghaddewhom lil nies Maltin lanqas Ghawdxin! U dan biex l gvern jghin l izviluppaturi ghax kollha flimkien u dan min fuq darna w ghad detriment ta pajjizna! Meta ser iqum dal poplu!! X mafia ta gvernnnnn!! L politici self employed, zviluppaturi jaghmlu l business flimkien! Isthu!.,

If the public doesn’t provide the 50 million, they will be in financial trouble. This is the second time they are asking for public money as an investment. So why don’t we invest in their financial ruin and maybe slow down this development madness that destroyed our island?

Jien per PRINCIPJU MA XTRATX DAWN IL BONDS meta nara il qerda li qed issir f ghawdex u l arroganza u IL HMIEG ta permessi li QED JIEHDUH bis sahha TAL MAFJA MALTIJA

Kieku kullhadd bhalek dal bniedem ma ibieghhx appartament iehor! Imma l poplu ma tantx jinteressah, l aqwa li jakwista bicca mbarazz milli qed jibni!

Kullhadd johrog il-BONDS qishom pastizzi. Issa jkollna xi Bond Default u jikrolla kollox f’temp ta nifs. The HOUSE OF CARDS will collapse dragging down Malta’s economy with it.

Ilna l isbah 30 sena nisimghuha did diska

I presume that the 25 Milliion Euro Bank loan which Portelli intends to cover with half of the new Bonds he is now issuing carry an 8% annual interest rate.

The new issue is offered at 5.4% interest – that is 2.6% lower than the Bank is charging Portelli.

That will benefit him by savings of 650,000 Euro annually in interest on Bank loans. Not an insignificant sum by any standards for an aspiring billionaire.

I am afraid, I cannot find a decent way to help him in his ventures – quite the contrary, as a matter of fact, since I am averse to greed, selfishness and illegalities.

By the way, I wonder how his – and his daughter’s – agricultural venture in the fields below Nadur is going on.

Presumably not that well to provide him with the additional capital he is looking for and not even with enough profits to pay interest on all the Bank loans he is burdened with!

L ghelieqi li semmejt inti taht n Nadur diga qed jikri l kmamar ghad divertiment! Imma miskina Chloe busy tahdem r raba w riedet l kmamar biex tahzen fihom!

A good time to bring him down for good, but they won’t and his continued destruction of Malta and Gozo will. continue unabated!

Didn’t want to pay the bank loan back so people buying the bond can. Kicking the can down the road is a bad habit. There will be another bond issued before this one expires to pay this one off

Lil kull Malti ta’ rieda tajba.

Tixtrux minn dawn il Bonds.

Tkunux ta’ ghajnuna ma min qed jithanzer u jfotti l ambjent ta’ madwarna.

B’hekk ikun hemm ic cans li dawn jittrazznu milli jkomplu jkissruna ghax il banek jiffrizawlhom kollox.

Kieku hawn poplu sura lanqas appartamenti ma jixtri min ghandu!

Malta’s Joseph Portelli and his heavily indebted web of companies layered like a wedding cake – when the rogue building craze will slow down he will fall like René Benko and investors will be rubbing their eyes…

For how much longer is this corrupt government going to put money into people like this that only continually destroy our country and wish only to continue doing so.

When the corrupt government stops being a developer himself! That means they are not going to stop destroying our country! But the gullible think its for the economy because that is what they were fed!

In the investment world there are various risks for one to consider when determining one’s investment risk appetite.

REPUTATION RISK always heads the appetite list.

I wouldn’t give him a cent he’s already destroyed malta and now parts of Gozo. Let him sink in the debt he’s created.

They have taken all the land overdeveloped Malta and Gozo, which has caused property prices to skyrocket. Now the average person can’t afford to buy a home. I say let them sink so property prices plummet and the average hard working people can afford a home.

The Whole country is just a big scam. Whatever direction you turn there’s corruption, greed and mismanagement. It’s not going to end well.