A recent Financial Services Tribunal ruled that the Malta Financial Services Authority (MFSA) has been violating its own rules since 2019 in a decision which could see the mass overturn of all enforcement decisions issued from that date onwards.

The tribunal examined the case against MC Trustees Ltd, a retirement scheme administrator, that was handed an enforcement action and a €160,000 fine in 2021. It found the decision to levy the penalties against it was taken in complete breach of the law and, therefore, ruled it invalid.

Presided by lawyer Ian Stafrace, the tribunal also decreed that the MFSA ignored its own rules. It used its executive committee to accuse, prosecute and judge a claimed infringement of financial regulations, rather than an independent Enforcement Decisions Committee.

According to a recent parliamentary question by Nationalist Party MP Jerome Caruana Cilia, the Enforcement Decisions Committee of the MFSA is not functional and has not even been created.

Describing the MFSA’s actions as a “serious breach” of the law, the situation has become even more complicated as the MFSA has been breaching the same rules since March 2019.

While the MFSA has appealed the decisions, industry sources told The Shift that the bid would likely fail, leading to a situation where all measures imposed by the regulator in the last four years could be cancelled using this ruling as a precedent.

This could also see the repayment of hundreds of thousands or even millions of euro in fines.

Where did the MFSA go wrong?

According to legal changes in the financial services industry regime, which entered into force in March 2019, all enforcement actions by the MFSA were supposed to be decided and executed by an independent Enforcement Decisions Committee.

This was necessary to distinguish between those filing the charges (the executive committee) and those deciding on the outcome.

However, despite the 2019 changes to the law, the MFSA never appointed this committee. Instead, it continued to take all its enforcement decisions through its executive committee, comprised of the most senior employees of the regulator.

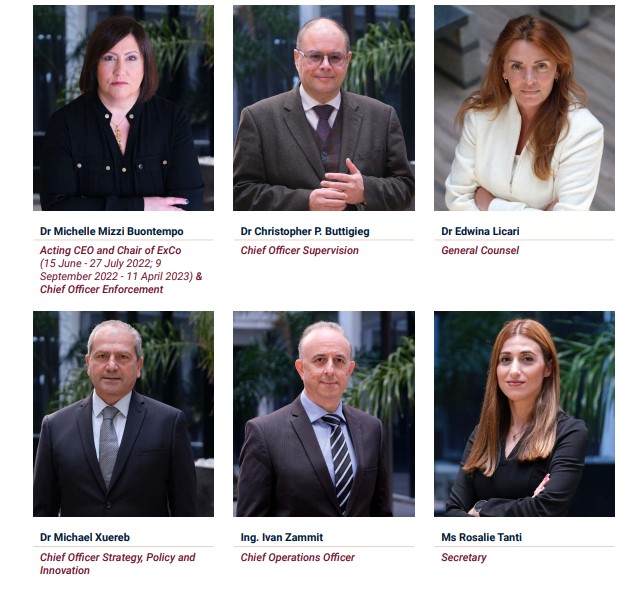

Members of the MFSA Executive Committee.

“The provisions of the law are clear enough, and the Authority clearly acted in breach of the provisions of the law when it simply ignored the provisions of Article 11 by first failing to appoint the Enforcement Decisions Committee and then by failing to recognise the distinction between the roles of its Executive Committee and the Enforcement Decisions Committee,” the tribunal stated in a damning decision.

“It is quite clear that as from the date of coming into force of Act VIII of 2019, the Authority had to refer decisions relating to enforcement to the Enforcement Decisions Committee,” the judgment states.

Declaring the decision in the MC Trustees Ltd case as illegal and void, the tribunal underlined that “this failure (by the MFSA) is tantamount to a serious breach by the Authority and a departure from the provisions of Chapter 330 of the Laws of Malta.

The MFSA, which falls under the remit of Finance Minister Clyde Caruana, is led by a board of governors chaired by Jesmond Gatt.

MFSA CEO Kenneth Farrugia

Its day-to-day operations are run by CEO Kenneth Farrugia, with Edwina Licari, Christopher Buttigieg, Michael Xuereb, Ivan Zammit, and Michelle Mizzi Buontempo forming part of the Executive Committee.

All receive a state-paid salary in the region of €150,000 per year.

Well there’s another surprise… yet another Government agency found to wanting in upholding the rule of law!

Executives very well paid from the public purse but ultimately incompetent.. the same few names keep repeating themselves in highly paid positions of responsibility and none of them actually shoulder any of this responsibility when their incompetence is revealed. The ever-patient Maltese taxpayer foots the bill yet again.

Don’t worry, they will all resign. Not.