World-leading cryptocurrency exchange Binance never paid a cent in tax in Malta during its shady stay on the sunny island, according to the findings of a special report published by Reuters.

The relocation of Binance to Malta in 2018 was, at the time, the crowning glory of the Joseph Muscat administration’s push to position Malta as ‘Blockchain Island’, at the height of the global crypto craze.

But even though billions of euros are believed to have passed through the exchange during its year-and-a-half sojourn in Malta, the company never paid a cent of tax to the Commissioner for Inland Revenue because the main company it set up in Malta somehow reported losses every year.

As part of its special report, Reuters sought to assess the amount of tax Binance pays by reviewing its public filings since 2018 in countries where it has said it has significant operations.

In Malta, where Binance said it was based for several years, Reuters found that its main local unit reported losses each year and as such it paid no tax.

In France and Dubai, where Binance established hubs last year, local units have not detailed tax payments while authorities in France and Dubai didn’t comment.

The only significant tax payments Reuters found were in Lithuania, where it found Bifinity paid €42.5 million in 2022.

Binance was first launched in 2017 in China and moved to Malta in 2018 during the ‘Blockchain Island’ fever. It moved to Malta after relocating from China and Japan because of the increasingly stringent regulations in those countries. It eventually left Malta when regulations for the sector came into force.

Binance set up shop in Malta in March 2018, and in October of that year, Malta passed its blockchain law that allowed crypto companies to apply for licenses to operate from the country.

Binance was operational in Malta between October 2018 and October 2019, when cryptocurrency companies that shifted to Malta had one year, until October 2019, to seek authorisation by becoming compliant with regulations.

Until that “grandfathering period” elapsed and their applications were processed, companies such as Binance were essentially exempt from the need for authorisation or even the need to comply with anti-money laundering laws.

This largely explains the rush of big companies, including Binance, in the sector registering their interest in setting up in Malta at a time when other governments were focusing on regulating the sector.

It was just before that concession period elapsed that Binance informed the Malta Financial Services Authority that it had abandoned its plan to base itself in Malta.

Another Reuters investigation recently showed how a torrent of illicit funds flowed through Binance between 2017 and 2021. It found that over that period Binance processed transactions totalling at least $2.35 billion from predicate crimes such as hacks, investment fraud and contraband drug sales. Binance’s period in Malta falls right in the middle of that.

Binance has processed at least $10 billion in payments for criminals and companies evading American sanctions, Reuters found in a series of articles last year based on blockchain data, court and company records.

That criminal investigation is reported to have begun in 2018, just as Binance landed on ‘Blockchain Island’. Those investigations are focused on Binance’s compliance with US anti-money laundering laws and sanctions.

But despite its departure from Malta at the end of the interim, loosely-regulated ‘grandfathering’ period, Binance kept exploiting the coverage it received in Malta to inform its users around the world that it was “governed under the laws of Malta”.

This led the MFSA, on two occasions, once in February 2020 – after the departure of Joseph Muscat, Keith Schembri and Konrad Mizzi from the government – and again in July 2021 to clarify that Binance is not authorised to operate under Maltese law.

“Binance is not licensed nor authorised by the MFSA to conduct any VFA-related activities in or from Malta and therefore falls outside the MFSA’s regulatory oversight,” the regulator said.

Although Binance had all but vanished from Malta, it left behind two companies that are still active: Binance Marketing Services Limited and Binance Europe Services Limited.

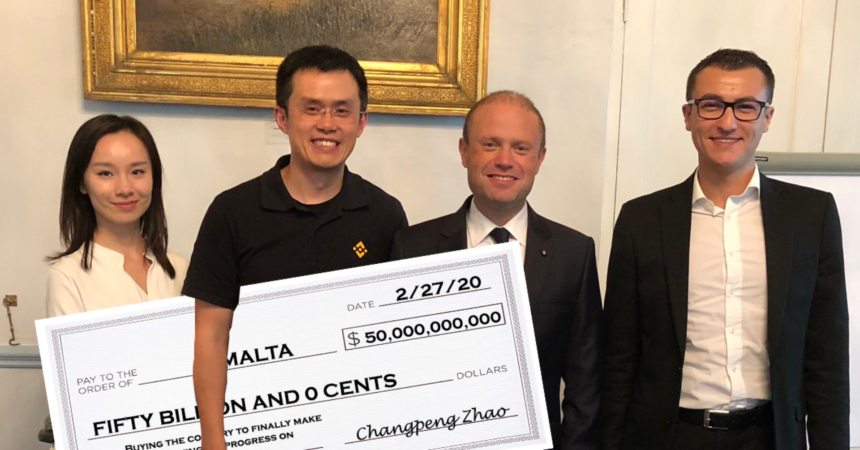

Both were set up in April 2018, are directed by Guangying Chen and are owned by Binance founder and CEO Changpeng Zhao.

Thares lejn wicchom, bizzejjed…….

Changpeng Zhao, came, had his way with Malta, and did not even leave any money on the dresser. LOL.

Like many other crypto operators, Binance took full advantage of operating of the 1 year grace period afforded to Crypto operators whereby they were exempted from applying for a license with the MFSA.

In fact, it appears that Binance was used to launder a significant amount of money via its operations in Malta during the period mentioned above.

Well another of the great projects embarked on under the Muscat regime. Kudos

The cash went by private plane to Dubai? Old Habits die hard.

maybe even further!

And Joe always told us the institution were working! So we facilitate crime and the country got nothing out of it, someone must have.

I have a gut feeling that this and every rotten deal took place so that many could dip their hand in the cookie jar

So who is responsable for the ‘grandfathering period’, was it the MFSA or the law?

This country has become a joke.

pull it down if it was built illegally – does anyone have balls in craneisland?

Obviouslly thats the reason they used Malta, or Costa Rica or portugal. As they are crypto heavens. I’m sure a decent chunk of that was invested or spent there from people that dip their hands in that cookie jar

Perhaps one should investigate also the minister promoting blockchain. Another name comes to mind who seems to talk air Eman Pulis.