Binance chief strategy officer Patrick Hillmann has admitted in an interview with The Washington Post that the world’s largest cryptocurrency exchange that set up shop in Malta in 2018 ‘had shortcomings in its approach to regulatory compliance in the first few years of its rapid expansion’.

Binance, launched in 2017, moved to Malta in those same early years, during the Joseph Muscat administration’s ‘Blockchain Island’ fever, after relocating from China and Japan because of their stiff regulations.

In its short time in Malta, Binance is believed to have been very loosely regulated, if at all.

According to Hillman, the company has now changed its ways and is attempting to make a clean break from its early days of shaky regulatory compliance.

As he told The Washington Post, “Over the last two years [i.e. since 2020], the company has completely changed its posture. Now that we have those resources, we are easily one of the most proactive parties to identify, freeze and get back funds” laundered.

Binance said it was to set up shop in Malta in March 2018, and in October 2018, Malta passed its blockchain law that allowed crypto companies to apply for licences to operate from the country.

Binance was operational in Malta between October 2018 and October 2019, when companies in the cryptocurrency space, particularly exchanges that shifted to Malta and before the October 2018 start date of the new law, had one year – until October 2019 – to seek authorisation by becoming compliant with regulations.

Until that “grandfathering period” elapsed and their applications were processed, companies such as Binance were essentially exempt from the need for authorisation or even the need to comply with anti-money laundering laws.

This largely explains the rush of big companies, including Binance, registering their interest in setting up in Malta at a time when other governments focused on regulating the sector.

It was just before that concession period elapsed that Binance informed the Malta Financial Services Authority that it had abandoned its plan to base itself in Malta.

An investigation by Reuters has shown how a torrent of illicit funds flowed through Binance between 2017 and 2021. It found that over that period, Binance processed transactions totalling at least $2.35 billion from predicate crimes such as hacks, investment fraud and contraband drug sales. Binance’s period in Malta falls right in the middle of that.

Reuters made the calculations by examining court records, statements by law enforcement and blockchain data that was compiled for the news agency by two blockchain analysis firms.

Now US federal prosecutors are examining American hedge funds’ dealings with Binance as part of their long-running investigation into potential violations of money-laundering rules at the exchange. It is likely they are also focussing on Binance’s stretch in Malta.

In recent subpoenas being reported by The Washington Post, the US attorney’s office for the Western District of Washington in Seattle has instructed investment firms to make records of their communications with Binance available.

That criminal investigation is reported to have begun in 2018, just as Binance landed on ‘Blockchain Island’. Those investigations focus on Binance’s compliance with US anti-money laundering laws and sanctions.

But despite its departure from Malta at the end of the interim, loosely-regulated ‘grandfathering’ period, Binance kept exploiting the coverage it received in Malta to inform its users around the world that it was “governed under the laws of Malta”.

This led the MFSA, on two occasions, once in February 2020 – after the departure of Joseph Muscat, Keith Schembri and Konrad Mizzi from government – and again in July 2021 to clarify that Binance is not authorised to operate under Maltese law.

“Binance is not licensed nor authorised by the MFSA to conduct any VFA-related activities in or from Malta and therefore falls outside the MFSA’s regulatory oversight,” the regulator said.

Although Binance had all but vanished from Malta, it left behind two companies that are still active: Binance Marketing Services Limited and Binance Europe Services Limited.

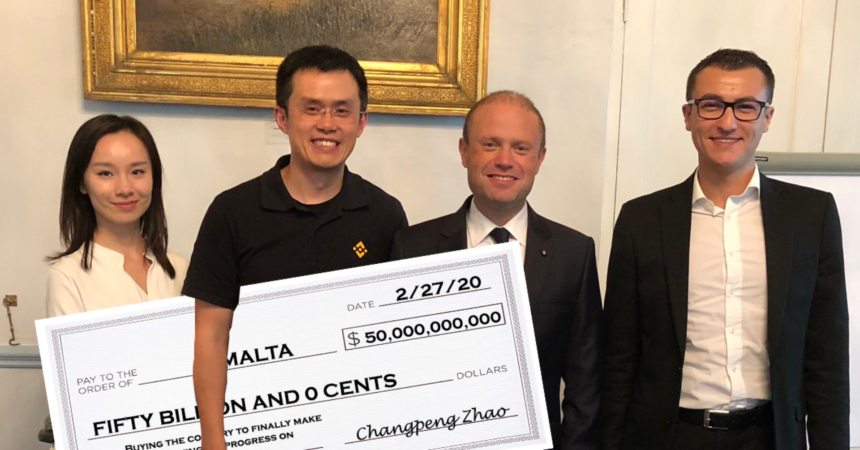

Both were set up in April 2018, are directed by Guangying Chen and are owned by Binance founder and CEO Changpeng Zhao.

MFSA’s Christopher Buttigieg promoted the flawed idea of blockchain island. He now tries to distance himself from such a failure. Taxpayers’ monies down the drain. Will he resign?

https://twitter.com/MFSAComm/status/1111238356757819392

Of course he won’t resign. He knows way too much about what was going on so he’ll be safe forever and a day,

In fact like Edward Scicluna he’ll probably end up with a promotion and a huge salary increase to ensure his lips remain sealed.

He already enjoyed several promotions since Labour got into power. Oh by the way, he did not cancel the license of Pilatus Bank. How come?

Prosit SCHEMBRI u Dakkkk kemm ftahartu bil BLOCKCHAIN ISLAND Fix gibtu lil Malta f halq il HMIEG kollu mad dinja. Kif jistaw jadawna bil li bqajt ministru Silvio. Il prim GHANDU iwarbek illum qabel Ghada jekk vera irid innaddaf isem Malta.

50 million and no sense should ready that cheque.

Another cast iron nail in the coffin of our worlwide notorious financial services reputation which will remain embedded in the world’s politico-economic history of money laundering in a non-regulated jurisdiction.