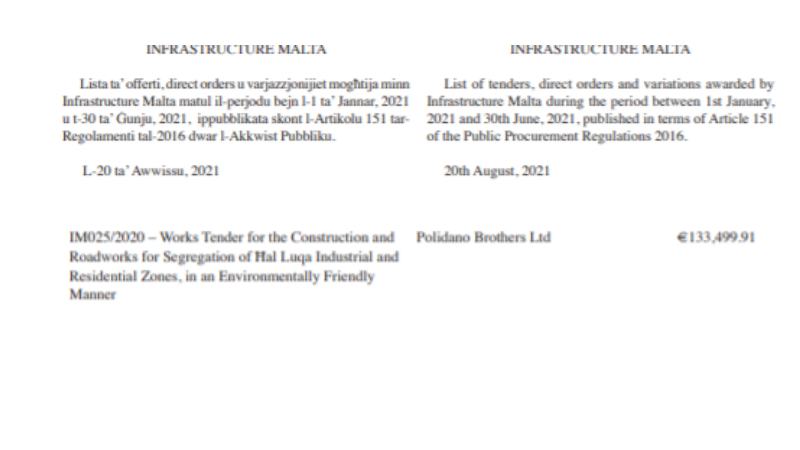

Infrastructure Malta last year awarded Polidano Brothers, supposedly blacklisted, a contract for various road works at the Luqa industrial estate while allowing him to bid for various multi-million infrastructure projects where he is in pole position to win despite his reported €40 million tax bill.

Despite publicising Polidano’s blacklisting due to taxes owed, Infrastructure Malta has allowed the contractor to bid for projects with a combined value of more than €40 million. They include the extension of Pinto Wharf in the Grand Harbour, the extension of the Marsamxett ferry landing place, the building of a breakwater and the upgrading of the Msida junction, including the construction of a controversial flyover.

Polidano is in pole position to win all three tenders according to public procurement rules as his company offered the cheapest bids.

When questioned, a spokesperson for the state agency controlled by Minister Ian Borg admitted that while Infrastructure Malta had introduced measures to make sure that participants of its Dynamic Purchasing System (DPS) are in possession of the appropriate tax compliance documentation, the measures did not go very far.

“While these measures are possible within the DPS, by law, Infrastructure Malta cannot prohibit companies or consortia from bidding for other works procured through other processes, such as public calls for tenders,” the spokesman said.

However, he underlined that the applicable regulations still stipulate that the winning bidder identified through a selection process for high value contracts needs to provide tax compliance documentation before being offered a contract.

“In this regard, Infrastructure Malta will ensure that the selection process for the indicated contracts strictly follows these regulations, as it has done in all other procurement processes since it was established in 2018.”

While Polidano is currently facing various court cases instituted by the Inland Revenue Commissioner over his pending tax bill dating back years, Infrastructure Malta still awarded him a contract in 2021 despite its publicised measures the previous year.

With at least nine pending court cases currently ongoing over his tax dues “it would be very strange for the Inland Revenue Department to issue Polidano with a tax compliance certificate as required by law,” according to experts in the field.

With at least nine pending court cases currently ongoing over his tax dues “it would be very strange for the Inland Revenue Department to issue Polidano with a tax compliance certificate as required by law,” according to experts in the field.

Polidano, through his various companies and joint ventures, is also involved in a number of other government projects, including with Gozitan developer Joseph Portelli, on the building of a new multi-million Gozo Olympic pool facility.

Tax discount arrangement denied

Last May, the government denied claims reported by The Times of Malta that Polidano had reached some sort of settlement to reduce his tax bill to just €10 million through a swap of property and pending payments he was due from the government.

The finance ministry had described the report as “manifestly unfounded and completely false”.

Research conducted by The Shift shows that Polidano is currently fighting nine court cases instituted by the Inland Revenue Commissioner over his tax arrears.

In the last session, held in November 2020, Polidano’s lawyers claimed that their client was due to receive some payments which would be used to pay some of his tax arrears.

However, the Inland Revenue Commissioner said these were still not enough to make the necessary payments and asked the court to proceed with all cases against Polidano.

The cases are being heard by Judge Francesco Depasquale, are set for another hearing in a few weeks’ time. In the meantime, various companies belonging to Polidano are still seen working on various road infrastructure projects across the island.

This island has become irredeemable. Only Mafiosi style people thrive.

Getting rich, destroying Malta’s environment and quality of life, subsidised by the Maltese taxpayer.. and helped along merrily by the representatives of those same taxpayers.

The so called economic boom over the last 10 years that the Labour Government constantly boasted about and still does, was all a fraud.

Entrepreneurs were doing well, but to fund their projects they did not pay taxes and VAT.

I can understand that a business might have cashflow problems, take the hotel and restaurant sector, due to Covid. But the construction industry and it’s associate finishing areas, electricians, plumbers etc. where going at full blast.

The question that one must ask and get a true answer is. Was this mess directly or indirectly known to the government, which did nothing about it? What does the former Minister of Finance have to say about it. Oh, but now he is Governor of the Central Bank, earning a fat salary + benefits. Well done Profs!

In short an economy based on “Karta Pesta”. Mostly used in carnival floats.