The largest-ever leak of offshore data, the Pandora Papers has stripped several layers of secrecy off the offshore industry’s continued efforts to conceal the hidden wealth of some of the world’s richest and most powerful individuals.

The extraordinary revelations depict activities ranging from missing taxes to stolen artworks and smuggled antiquities, and in some cases, money laundering.

Also featuring Malta’s own scandal-ridden former EU Commissioner John Dalli, the massive cache of documents exposes the financial machinations of hundreds of politicians, royalty, dictators and billionaires from around the world.

“The Pandora papers show that the advances in international tax cooperation are not enough,” German MEP Sven Giegold said in a statement. He called for tougher measures to combat tax evasion and money laundering, especially in those with “money and insolence,” who are still able to shirk their tax obligations.

“The new data leak must be a wake-up call,” Giegold said. “Global tax fraud fuels global inequality. We now have to expand and focus the counter dimensions.“.

This latest cache includes 11.9 million files leaked from a total of 14 offshore service providers hired by wealthy clients to create offshore structures and trusts in tax havens such as Panama, Dubai, Monaco, Switzerland and the Cayman Islands.

The files include over 6.4 million documents, almost three million images, more than a million emails, and almost half a million spreadsheets.

The data was leaked to the International Consortium of Investigative Journalists (ICIJ) in Washington DC, which has since partnered with more than 140 media organisations involving over 600 journalists in 117 countries, all of whom have been trawling through the files for months.

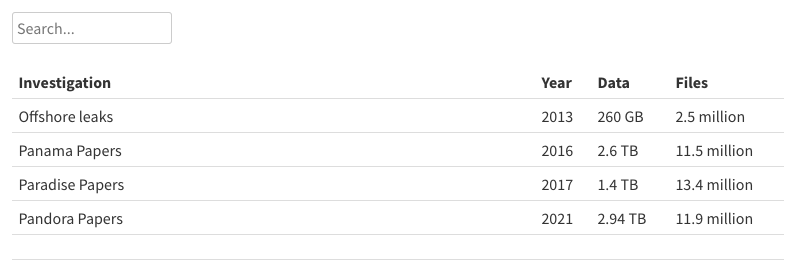

The data and files in each of the major document leaks. Source: International Consortium of Investigative Journalists

First revelations

The Pandora Papers reveal how more than 330 politicians from 90 countries used secret offshore companies to hide their wealth.

Some of the revelations include the King of Jordan‘s £70 million spending spree on properties in Malibu, London and Ascot through a network of secretly-owned companies and the use of an offshore investment company to acquire a $22 million chateau in the south of France by Andrej Babiš, the prime minister of the Czech Republic, who is up for re-election this week.

The files also expose how Azerbaijan’s ruling Aliyev family traded close to £400 million of UK property in recent years, including a £33 million office block in London for the president’s 11-year-old son Heydar Aliyev.

One of the Aliyev’s properties was later sold to the Queen’s crown estate, that said it carried out the checks required by law at the time of purchase but is now looking into how it came to pay £67 million to a company that operated as a front for the family routinely suspected of running one of the world’s most corrupt countries.

The name of disgraced former European Commissioner John Dalli also features in the Pandora Papers which expose how he owned an offshore company in the British Virgin Islands that he never disclosed in his obligatory asset filings.

An opaque parallel world

The leaked documents did not just reveal the workings of politicians. Journalists have found names of more than 100 billionaires, as well as celebrities, rock stars and business leaders, many of whom use shell companies to hold their luxury items such as yachts, properties, hidden bank accounts and artwork that include stolen Cambodian antiquities, Banksy murals and paintings by Picasso.

More broadly, the revelations by the Pandora Papers further illustrate the central coordinating role London continues to play in this opaque offshore parallel world.

London is home to wealth managers, law firms and accountants that exist to solely serve the ultra-rich. The British government has failed to introduce a register of offshore property owners despite repeated promises.

Speaking to The Guardian, ICIJ Director Gerard Ryle said at least $11.3 trillion in wealth is held offshore, according to a 2020 study by the Paris-based Organisation for Economic Co-operation and Development (OECD), meaning that “this is money that is being lost to treasuries around the world and money that could be used to recover from Covid”.

Featured image credit: ICIJ

Disgraced corrupt former EU commissioner John Dalli and his family members seem to have a habit of setting up offshore companies and bank accounts. For many years he claimed that these were dormant or set up to test the waters as he had said about his Pilatus Bank account.

Unfortunately for him, no one seems to believe him. However, the police seem to. At least that is the impression the police give. If they didn’t believe him they would have searched his properties and confiscated all computers and laptops and examined them for any evidence to confirm his claim that the offshore companies and bank accounts were dormant.