An investigation by the Commission against Corruption into former minister Chris Cardona’s aide Charles Portelli’s assistance to businessman Philip Attard of Dexter Movers – which saw his tax bill reduced by hundreds of thousands of euros – has found no tangible ‘proof’ of corruption in the process involving high officials at the Department of Inland Revenue.

At the same time, the Commission said this finding should not stop the authorities, particularly the police, from investigating the case further.

The investigation was triggered in 2016 when the then-leader of the Opposition, Simon Busuttil, passed on an anonymous letter he had received alleging corruption between a member of Cardona’s secretariat, officials at the Inland Revenue Department and a businessman involved in furniture removals.

The letter alleged that after receiving a tax bill of €280,000, due to an assessment made by the Inland Revenue Department, based on years of under-declarations, Attard sought the help of Charles Portelli, then serving as Cardona’s deputy chief of staff.

It was also claimed that following Portelli’s intervention, Attard’s tax bill was reduced to just €30,000, and the issue was settled within a month.

The facts

The Commission against Corruption’s investigation established that while it was true that Attard’s €280,000 tax bill was reduced, the final amount was €80,000, and not €30,000 as claimed.

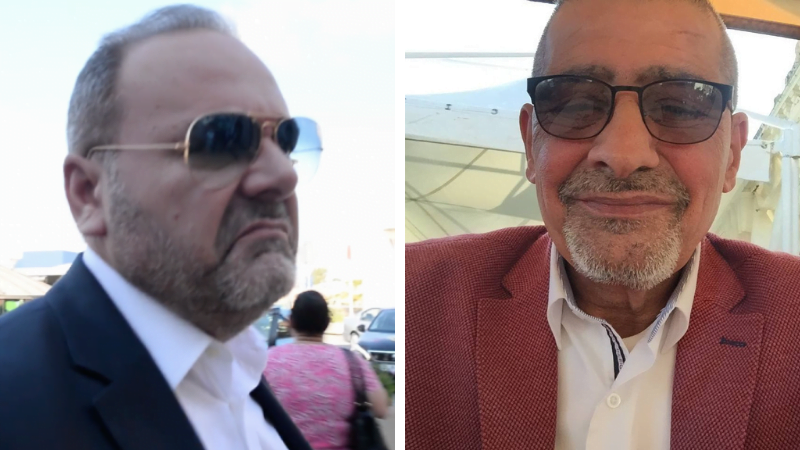

According to the evidence, after Attard received the original tax bill, he sacked his long term accountant to switch to the firm CP Portelli Tax and Management Consultants. The latter is owned by DVD shop owner Renato Portelli. The Commission flagged this move as strange.

It also found that Renato’s father, Charles Portelli, was effectively managing the ‘tax assistance’ business.

Portelli acknowledged to the inquiry that he ‘assisted’ his son with his work even though neither he nor his son was certified accountants.

Portelli told the Commission that his contact at the Inland Revenue Department was Frans Farrugia, the Director of Tax Audits, although he denied ever discussing the client’s case with him.

He said that neither he nor his son had ever spoken to Minister Cardona about the case or put any undue pressure on Farrugia on behalf of the ministry.

He also denied under oath that he had ever given any gift to Farrugia, and said the issue was resolved ‘normally’ as both he, as consultant, and Attard, the taxpayer, fully cooperated with the department and a settlement was reached without difficulty.

Frans Farrugia, identified as the person mainly responsible for the quick settlement of Attard’s outstanding taxes, testified that it was true he’d met Portelli over the issue, but only in his capacity as the taxpayer’s consultant.

He said that while this was normal, it was also commonplace for hefty tax bills to be reduced substantially because original assessments are based on assumptions. If these are later proven erroneous, that fact would be reflected in the final settlement.

While Farrugia said that he was responsible for this arrangement, he refuted any insinuations that he had acted under any form of political pressure or that he had received some form of compensation from the taxpayer or Portelli.

Inland Revenue Commissioner Marvin Gaerty told the investigation that while he was not aware of this particular case, the issue looked very ‘strange.’ He said it was not normal that such a file would be handled by Farrugia’s department, or that such a complicated issue would be settled in a month.

While admitting that tax assessments are ‘normally’ reduced after negotiations with taxpayers, Gearty said it was unusual for Farrugia and his department to have “accepted what was given to them by the taxpayer without any evidence”.

Other tax officials were questioned by the Commission. They all refuted allegations of wrongdoing and said they acted under the instructions of their bosses, particularly Farrugia.

Conclusions

Despite the ‘strange’ deal outlined in the 700-odd transcript pages, the Commission concluded that it had not managed to find evidence of wrongdoing.

Since the claim was made anonymously and remained so, the Commissioner said, “its conclusions do not preclude the re-opening of the case, even by the police, if it received some firm of new evidence proving corruption”.

It also recommended that from now onwards, for the sake of transparency and accountability, and to avoid any conflict, no employee of any ministry should be allowed to represent taxpayers in such cases.

Dawn jaħsbuna boloħ?

Inkredibbli! M hemmx izjed x izzid!

Here we go again… another reason why Pieter Omtzigt-the Moneyval Rapporteur-,the 635 MEPs and the FATF all decided on the balance of evidence put before them and without a single successful prosecution brought against those identified in scandal after scandal, the Government cannot be trusted “ to do the right thing”.

No need to say any more!

And if the Government does not take the bull by its horns and starts the cleaning Malta risks being kicked out of the EU

‘ no employee of any ministry should be allowed to represent taxpayers in such cases ;

Its about time for such action to be introduced.

Continuity of the L’aqwa-Zmien saga.

What did the Corrption Commission expect? That those involved would admit? Were they impressed because those under investigation made their statements under oath? How damn naive. What a waste of 700 pages.

Liġi għalina u liġi għalihom.

So we are waiting for the police to investigate further? They have chapter and verse,and all the evidence needed,but won’t move a muscle.

I quote Renato Portelli “Ghadna King Gdid” Alikom hu kink izda al poplu li mandux partit jaf li mhux king gdid ghadna izda PUPAZZ!

U Stunt man ta’ JM