Updated with Right of Reply sent by Salman Rahman on 18 June.

It looked like a match made in heaven.

On the one hand, Yorgen Fenech, who was backed by Malta’s power behind the throne, the prime minister’s chief of staff.

On the other, a businessman and senior advisor to the prime minister in a particularly autocratic and corrupt country, Bangladesh.

Fenech is accused of being a co-conspirator in the assassination of investigative journalist Daphne Caruana Galizia.

The Bangladeshi businessman and advisor is Salman Rahman, one of the owners of the Beximco Group, a conglomerate with interests in pharmaceuticals, aquaculture, textiles, ceramics, energy, media and financial services. Never too far away from controversy and claims of corruption, Rahman is now also an MP in Bangladesh’s parliament.

What brought the two together is still unclear. Some sources claim that Fenech’s older brother met one of Rahman’s sons at rehab and the two got talking. Others point to a different sort of introduction.

What is clear is that in late October 2015, Fenech and his brother Franco flew to Dhaka, Bangladesh, to visit Beximco and the big man himself.

The entire visit was chronicled by Franco on his social media including how the visit “exceeded his expectations”.

Source: Instagram

It did eventually lead to a ‘business plan’ and altered Bangladesh’s energy master plan, even if not as the Fenech brothers expected.

The 17 Black (and Macbridge) trail pointed to Bangladesh

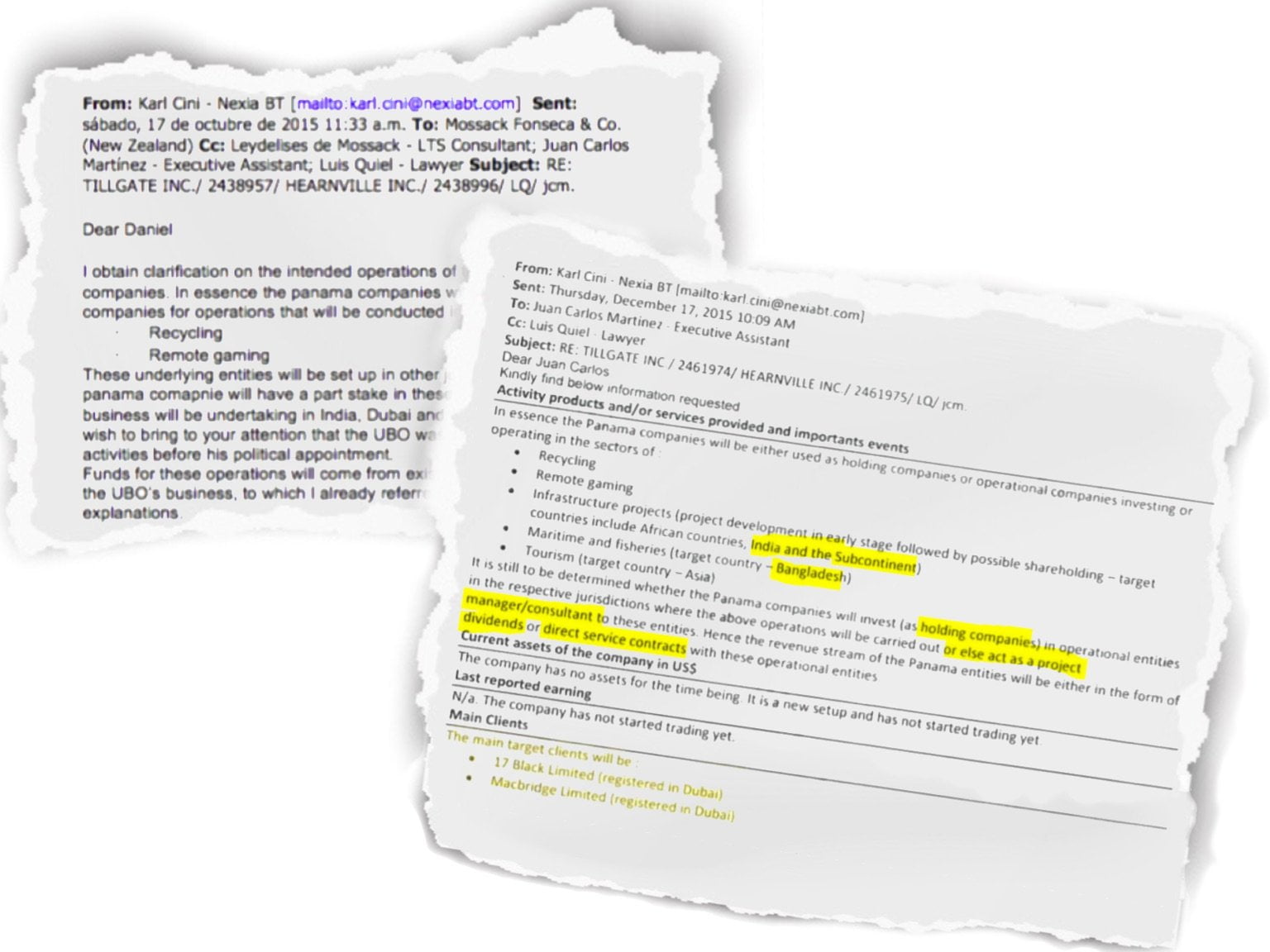

October 2015 is also the month when Karl Cini from Nexia BT sent an email to Daniel Leon from Mossack Fonseca’s (MossFon) New Zealand office in connection with the creation of two Trusts.

In Leon’s own words, MossFon’s New Zealand office offered a very particular service for discerning clients wishing to avoid appearing on public paperwork – Trusts.

These two Trusts were needed to further shroud Tillgate Inc. and Hearnville Inc., Keith Schembri and Konrad Mizzi’s then-secret Panamanian companies.

Cini explained to Leon that the purpose of the Panamanian companies was to hold shareholdings in companies active “in the sectors of recycling [and] remote gaming” (online casinos), noting that the recycling business would take place in India, Dubai and other Gulf countries.

By December 2015, this rather dry business plan would expand dramatically. Cini then sent another email, this time to Juan Carlos Martinez from MossFon’s head office in Panama, in connection with the opening of bank accounts for Schembri and Mizzi’s companies.

The previously dry “recycling and remote gaming” business plan now included three additional items: Infrastructure projects with target countries including Africa, India and the sub-continent (Pakistan, Bangladesh, Bhutan, Nepal, Maldives and Sri Lanka); maritime and fisheries with just one target country being Bangladesh, and tourism in Asia.

The email noted that the beneficial owners were still figuring out whether they would get their income through dividends (as shareholders) or as fees for project management/consultancy services.

But they did know who their main clients were going to be: 17 Black Ltd (Dubai) and Macbridge Ltd (Dubai).

Leaked emails from Panama Papers show that Schembri and Mizzi’s ‘business plans’ increased dramatically between October and December 2015. Source: ICIJ

It would be naive to point to the Fenechs’ Bangladesh visit as the prime driver for the change to the Panama companies’ business plan, particularly given the flurry of multimillion deals being signed by Schembri and Mizzi at the time, but it is hard to ignore the references to Bangladesh.

Which is what led The Shift to start investigating their business interests in Bangladesh in the first place.

They planned to expand

17 Black would later be identified by Reuters and Times of Malta as being a company set up in the Ajman Freezone, UAE and owned by none other than Yorgen Fenech.

Multiple reports, as well as documents seen by The Shift, indicate that 17 Black (later renamed Wings Development Ltd) was largely funded by hefty payments from Azerbaijani- linked entities – Turab Musayev’s Cifidex Ltd. (€7.8m), Mayor Trans Ltd (€2.3m) and Crowbar Holding Ltd (€1.4m).

Cifidex was the company involved in the Montenegro wind farm scandal that on-sold its shares in the deal to Enemalta at a hefty mark-up.

Macbridge and its owners remain a mystery to this day.

One thing that perhaps has not been spelled out enough is that SOCAR, the Azerbaijan State’s oil company, did not ‘need’ the Electrogas contract in Malta.

SOCAR could do with (and got) positive exposure particularly given its own wider European pipeline plans at the time. We also know that Malta got a rotten deal with the country being bound to buy Liquified Natural Gas (LNG) from SOCAR at what turned out to be an inflated rate for years.

But, in the greater scheme of things, the Malta contract that granted SOCAR a mark-up of $40 million a year (based on 2017 prices) for five years, plus a few million from the power station contract itself, was perhaps not that big a deal for SOCAR.

To put the $40 million into perspective, SOCAR’s declared gross profit in 2017 was $54 billion.

SOCAR’s senior management in Malta during the ‘HFO to gas’ event in Malta. Musayev is second from right.

Yet, Musayev’s project – SOCAR Trading (STSA), a Switzerland-based oil-trading subsidiary – may have stood to gain.

Prior to 2013, STSA was only known as a player in the trading industry for dealing in Azerbaijani crude oil, known as Azeri Light.

Yet at the time the flavour for traders and countries was increasingly LNG, a space in which STSA had no track record. Neither did Azerbaijan in any significant way.

In fact, under the contracts that Malta signed, STSA buys its LNG from Shell who, in turn, procures it from Trinidad and Tobago, and Nigeria.

Emails seen by The Shift show that STSA used the Electrogas project in Malta as a showcase, regularly inviting high-level delegations from as far as Qatar, Kenya, Namibia or Ivory Coast in order to demonstrate what they are capable of doing.

One such pitch also took place in Dhaka, Bangladesh.

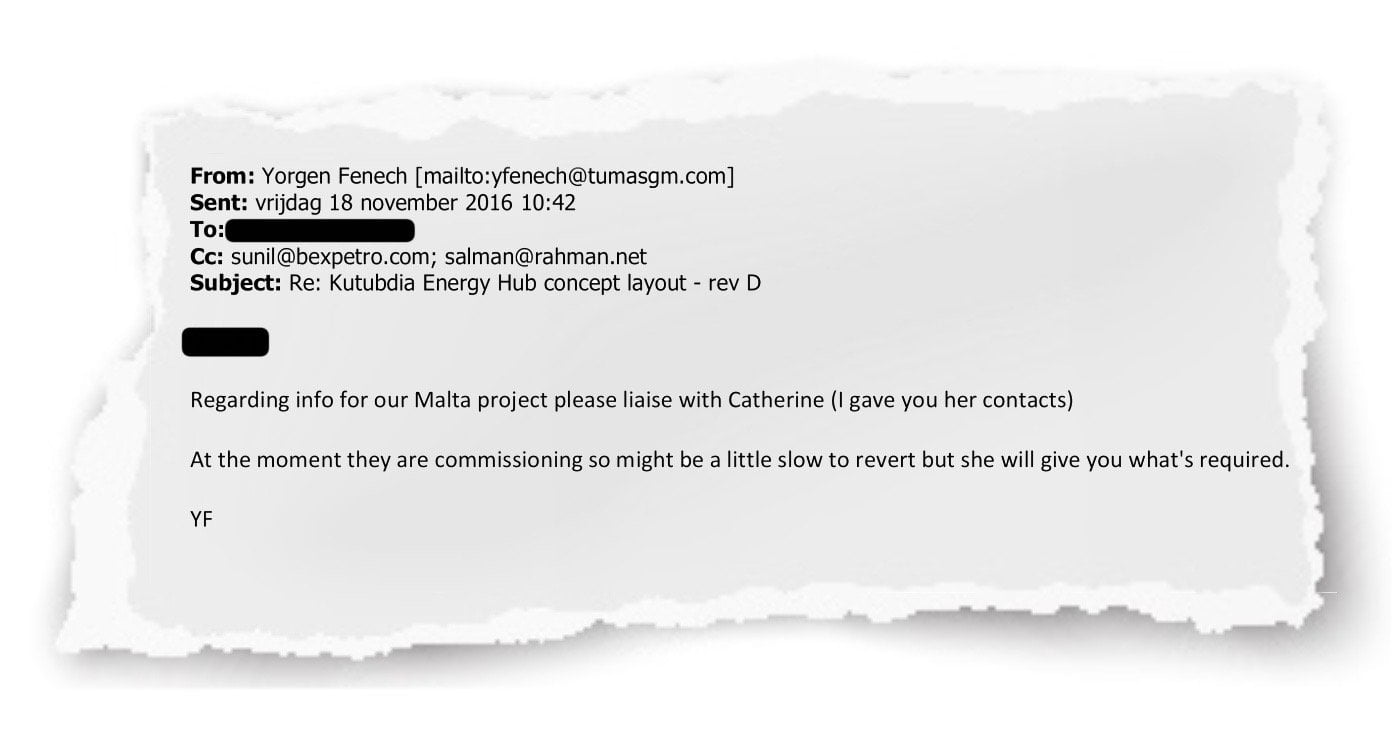

In September 2016, Yorgen Fenech sent an email to Electrogas Commercial Director Catherine Halpin noting that he was in Dhaka with Musayev giving a presentation on and asking for some “actually” photos of the Malta power station to use them in their presentation.

A Bangladeshi Electrogas

At that time in 2016, Bangladesh was mid-way through a widely expected project that had LNG traders abuzz, the revision of its Energy Master Plan.

The process would drag on until late 2017 but the conclusions were clear: Bangladesh needed to dramatically increase its importation of LNG and power generation capacity.

The Gas Sector Master Plan 2017 for Bangladesh was finally published by PetroBangla, the Bangladesh equivalent to Enemalta, on 28 February 2018. On page 165 of the report, two familiar names stand out: Beximco and Tumas Group from Malta.

Excerpt from Bangladesh’s Gas Sector Master Plan 2017 published in February 2018. Source: Petrobangla

Documents seen by The Shift indicate that the conversation between Yorgen Fenech and Rahman Salman must have quickly drifted towards replicating Electrogas in Bangladesh.

As early as February 2016, 17 Black / Wings Development and a linked company also owned by Fenech in the UAE (Wings Investment) made the first payment to Dutch energy consulting firm Royal Haskoning DHV (RHDHV).

Over the course of the next 19 months, Fenech’s UAE companies would pay €250,000 to RHDHV for its services.

RHDHV was, according to sources and documents seen by The Shift, engaged by each of Fenech and Beximco to work on plans and designs for an “Energy Hub” in Kutubdia, Cox’s Bazar, in the South East of Bangladesh.

The “Energy Hub” would include both a Liquified Petroleum Gas facility (Beximco’s area of business) as well as an LNG plant, just like the one in Malta.

Leaked internal correspondence from late 2016 seen by The Shift shows that RDHDV were promised the project designs from Malta to be able to replicate them, or at least use them as a starting point, in Kutubdia.

In November 2016, RDHDV reached out to Electrogas’s Commercial Director asking for copies of layout drawings and reports and details regarding the Electrogas tanker, including its “storm mooring” system with a view to applying these in Bangladesh.

News reports in Bangladesh show that in late 2016 Beximco proposed to enter into a joint venture “with Tumas Group in Malta” to build the “Energy Hub” and that in fact a Memorandum of Understanding (MOU) was signed in February 2017 with the Bangladeshi Ministry for Energy and Petrobangla.

The project is described as an FSRU (Floating Storage Regasification Unit) with a generation capacity of between 600-1000 MWh and as a BOOT (build, own, operate and transfer project), just like Electrogas.

Leaked emails show Yorgen Fenech discussing the Bangladesh LNG project with Beximco representatives including Salman Rahman and their consultants RDHDV.

While Rahman’s unparalleled access to those in power in Bangladesh evidently helped secure this Memorandum of Understanding (MOU), it is not clear what Tumas Group, or rather Fenech who was personally set to get 30% of the project, was bringing to the table beyond the copy-paste plans of the Electrogas project in Malta.

It seems Fenech cut the rest of his Electrogas partners (Gasan and Apap Bologna) out of this particular deal with each claiming to be unaware of this venture, according to testimonies from the Daphne Caruana Galizia public inquiry.

The question remains: Who else was aware and planned to profit from this?

The evidence surrounding the case, including fees for work coming from 17 Black which is heavily linked to Azerbaijani money and Bangladesh’s inclusion in Schembri’s “draft business plans”, suggests Fenech had backing from those in power.

The Bangladesh project (sort of) drops off the radar

Despite the publication of the 2017 Bangladesh Gas Power Master Plan in February 2018 showing Beximco and Tumas Group as joint venture partners for an LNG plant, it appears that something changed.

Sources point to Fenech likely realising that implementation may be difficult despite having on board the equivalent of Keith Schembri at the time in Bangladesh.

Others indicate that by late 2017, or at the start of the following year, Petrobangla ditched the proposed use of floating LNG tankers, reportedly due to Bangladesh’s extreme tides and shifting sands. Instead, they opted for land-based solutions.

In September 2017, Fenech’s payments to RHDHV through his Dubai companies stopped abruptly.

Beximco tried to continue the LNG project without Tumas Group’s involvement but failed due to what international industry sources described as “their sheer ineptitude”.

Yorgen Fenech and his brother’s outing to Bangladesh in October 2015 seems to have sparked a discussion to emulate Electrogas Malta in Bangladesh. In photo: Franco Fenech (left) and Salman Rahman (middle). Source: Instagram

Other sources on the ground in Bangladesh point out that there is no trace of the project or even of the MOU – no surprise given the country’s notorious lack of transparency.

They moved on without Yorgen Fenech

As recently as July 2019, Beximco was seeking 700 acres of land in Kutubdia from the energy ministry to implement an “energy hub”.

Yet Tumas Group was replaced by a company called Index Group. It appears to be related to Beximco, according to sources in Bangladesh.

More recent press reports from July indicate that Beximco found a new partner in Indian State-owned company Indian Oil.

In sum, they seem to have moved on without Tumas Group.

All persons involved deny any wrongdoing. Yorgen Fenech has entered a plea of not guilty to the charges in relation to the assassination of Caruana Galizia. Konrad Mizzi remains evasive and continues to exercise variants of his ‘right to silence’. Keith Schembri has publicly acknowledged that “17 Black and MacBridge were included in draft business plans for [his] business group as potential clients” and that he included 17 Black because he was good friends with Fenech and wished to do business with him “after he left politics”.

With additional reporting by Joseph Allchin, a British-born freelance journalist, writer and analyst formerly based in Dhaka. Allchin has written for the Financial Times, The Economist and The New York Times.

Salman Rahman replies

On 18 June, six months after the publication of the investigation, The Shift received the following as a Right of Reply:

“The Shift article ‘The 17 Black trail to Bangladesh’ inaccurately represents Salman Rahman’s brief association to Yorgen Fenech. Mr Rahman was introduced to Yorgen Fenech because he was interested in building a power station in Bangladesh. Mr Rahman became aware that a very similar one was being built in Malta and a colleague introduced him to Mr Fenech, as he was responsible for building the Malta power plant together with Siemens and Socar.

The Shift article states the project did not continue due to alleged “ineptitude”. This is not correct. Mr Rahman commissioned a feasibility report from one of the world’s leading engineering consultancy firms, Royal Haskoning, who concluded that the project was not favourable so he did not pursue the matter any further.

Mr Rahman’s introduction to Mr Fenech was not through his son, nor has his son ever attended a drug rehabilitation centre.

To suggest that there was any other relationship with Mr Fenech than that described above is wholly untrue.

Av. Malcolm Mifsud.”

This is a detailed and excellent piece of writing. My worry is that it is just too complicated for people to understand. I think of myself as fairly ‘with it’ but I must admit that I got lost and mixed up half way through reading this, I tried 3 times to understand it but, I am not important, I just wish there was an easier way to get this ‘scheme’ across to people.

Judging by this photo I would say it was not just Beximco to be inept and way over their heads

Bangladesh are not just Bangali speakers from the Indian continent but majority Muslim. The most rude thing you can do is to sit showing the bottom of your shoes as that ignorant and loutish Frank is doing.