Electrogas shareholders hid over €16 million in ‘success fees’, on top of a secret deal signed with Azerbaijan’s SOCAR, from the European Commission, according to leaked emails seen by The Shift.

Electrogas shareholders (GEM Holdings, SOCAR, Gasol and Siemens) paid themselves over €16 million in “success fees” out of loans granted to Electrogas on the back of a last-minute multi-million State guarantee.

The success fees, which coincided with interim bank loans being taken out by Electrogas in 2014 and in 2015 and corresponding State guarantees to secure them, were paid two full years before Electrogas first generated electricity.

The European Commission was kept in the dark.

This is on top of the government hiding the ‘Security of Supply Agreement’ signed by disgraced former Minister Konrad Mizzi with Azerbaijan’s SOCAR Trading undertaking to buy liquified natural gas (LNG) for the Electrogas power station for 18 years at ridiculously inflated prices, as revealed by The Shift.

Now, new findings show that the over €16 million in ‘success fees’ – a form of commission, typically used to pay external advisors as a reward for procuring finance or assisting with a successful transaction – was also kept hidden from the European Commission, according to the leaked emails.

Shareholders’ returns was a key consideration for the European Commission when assessing whether to approve the government’s State Aid to Electrogas in 2017.

The promoters behind Electrogas at a vanity award event.

Documents seen by The Shift show that the Commission indicated to the government that, given the flawed tender process and State Aid already disbursed, it would need to satisfy the Commission that the concession fell under a particular framework (the Services of General Economic Interest Framework) which required, among other things, that there be no “overcompensation”.

Internal emails show mentions of a focus on potential “overcompensation” worried Electrogas shareholders, particularly Siemens.

Finance lawyers contacted by The Shift noted that it is highly unusual for the shareholders of a project company such as this to pay themselves ‘success fees’ even before the company starts operating, adding that these very much risk being re-characterised as unlawful dividends or distributions.

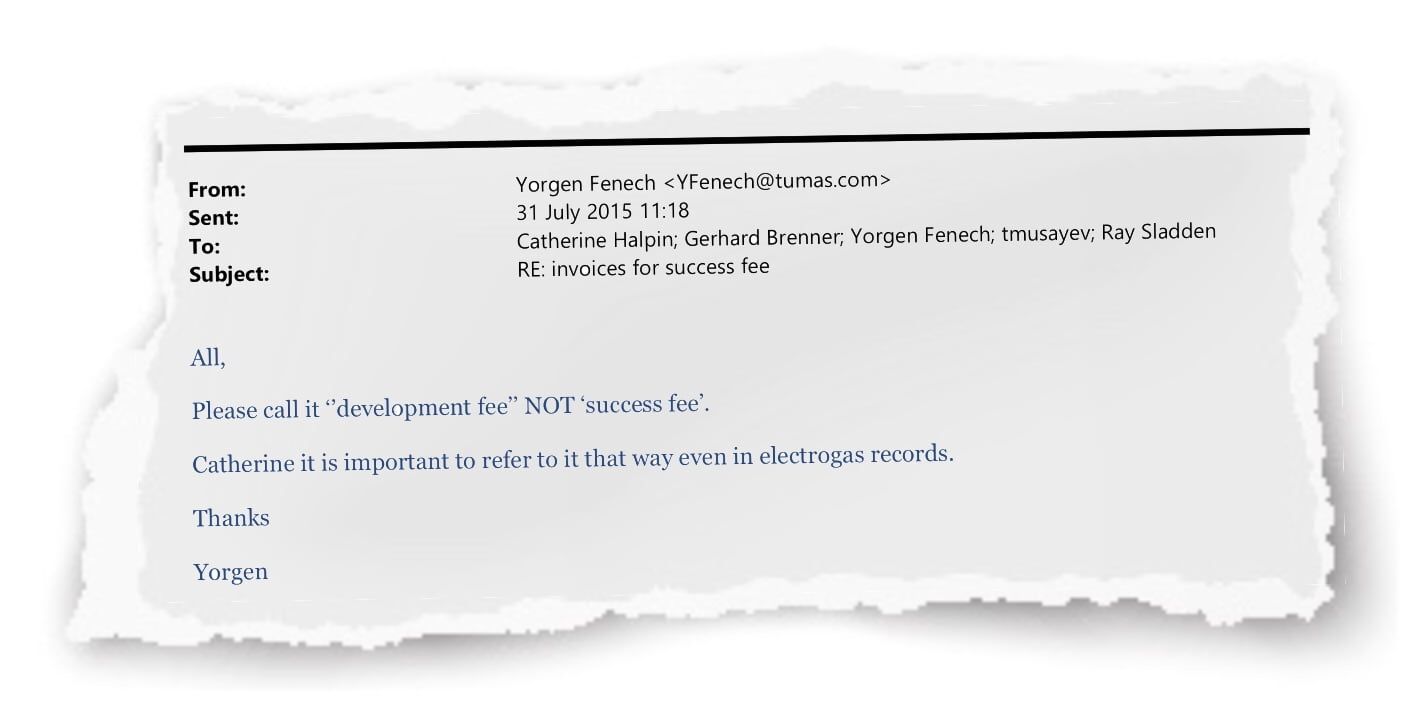

Leaked emails show that Electrogas shareholders also sought to disguise the true nature of these distributions, misleadingly describing them as ‘development fees’ in Electrogas’ internal records – on Yorgen Fenech’s instructions.

Electrogas intentionally bundled these disguised distributions together with actual development costs in submissions to the European Commission, understating shareholders’ returns by €16.86 million in the process.

Finance lawyers contacted by The Shift noted that it is highly unusual for the shareholders of a project company such as this to pay themselves ‘success fees’ even before the company starts operating, adding that these very much risk being re-characterised as unlawful dividends or distributions.

Fenech’s New Energy Supply Ltd, a minority shareholder in GEM Holdings, was to receive €2.5m of these success fees for “interfacing with the authorities” under a side agreement with GEM signed in 2014.

Fenech, the Tumas Group heir accused of conspiring to murder journalist Daphne Caruana Galizia, was also the owner of Dubai company 17 Black, the kickback company registered in the Ajman Free Zone that Caruana Galizia was investigating.

A flawed procurement process, hidden agreements and an early payday

Much has already been said about the process leading up to the award of the concession to Electrogas notably accusations of this being a “predetermined deal” and the National Audit Office’s (NAO) uncharacteristically harsh criticism of the process.

Even the Commission was highly critical of the tender process noting that the outcome was influenced by the late addition of a “security of supply agreement” (an undertaking from Enemalta to purchase all the winning bidder’s electricity for 18 years).

Further, leaked documents seen by The Shift also show that the Commission outright questioned the government about the €430 million State guarantee and whether, since this was never mentioned at tender stage, there was a risk of the tender’s legal validity being challenged. The government had denied this risk existed.

In December 2013, the concession was awarded to the Electrogas consortium which then sought to implement the project and finalise the negotiation of the agreements.

One of the key points was obtaining access to funding in order to commence construction. According to the NAO, it became apparent in mid-2014 that Electrogas would not be able to obtain funding without the Security of Supply Agreement and that given the size and risks of the project the government wished to obtain the Commission’s sign off from a State Aid perspective.

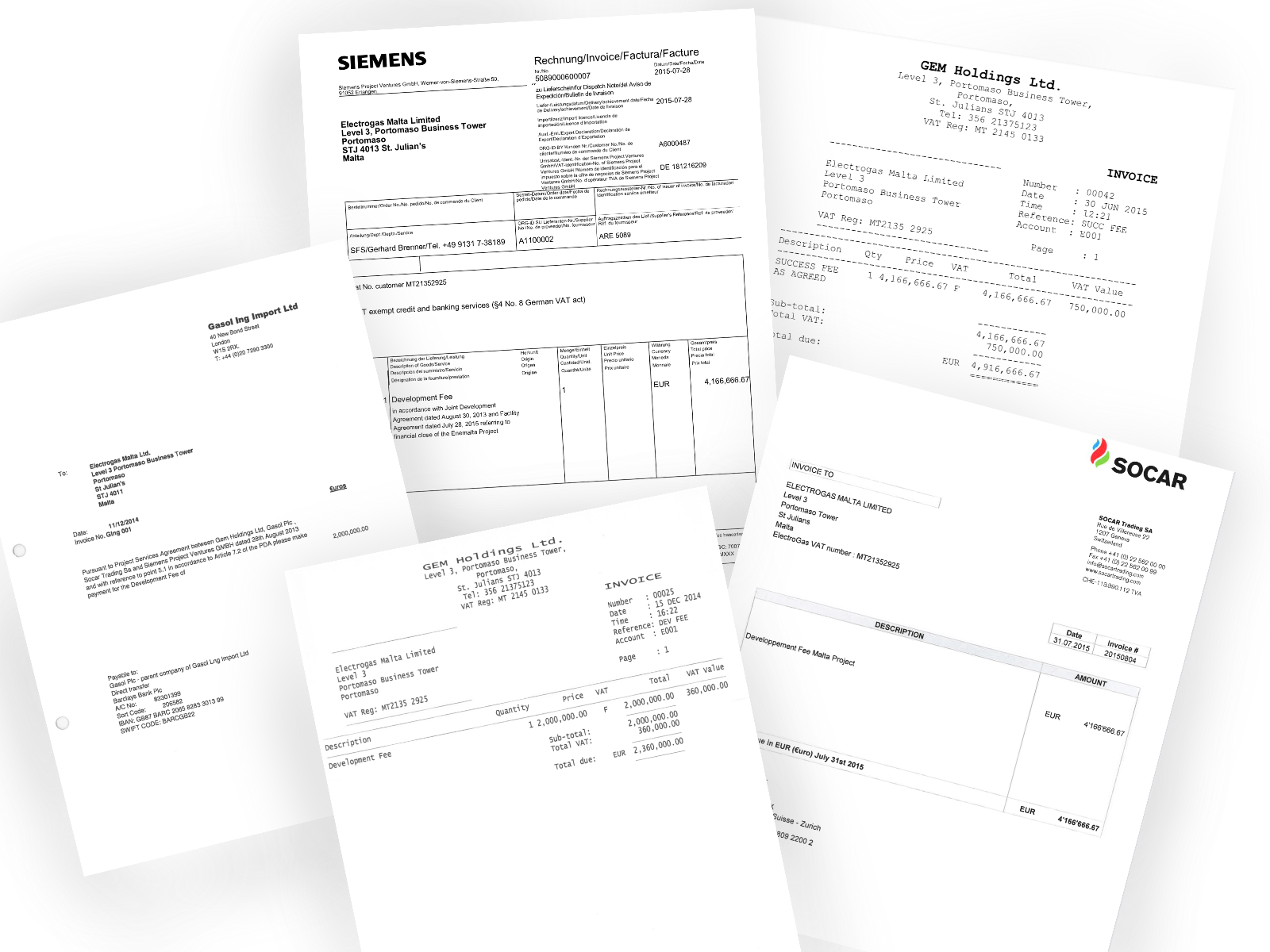

Copies of invoices issued by the shareholders of Electrogas for over €16m in “success fees”.

Notwithstanding this and given all parties’ evident wish to rush things along, each of Bank of Valletta and the government agreed to extend a €110,000,000 interim loan backed by an 80% State guarantee to Electrogas on 18 and 19 December 2014 respectively.

That same day, Electrogas requested a drawdown from Bank of Valletta of €38.4 million from the loan to cover myriad expenses including over €3 million in legal and advisory fees.

Among the amounts requested were €2 million for GEM Holdings and €2 million for SOCAR (on behalf of Gasol plc) for what was, according to the respective invoices, described as a “lead development fee”.

Documents seen by The Shift show that GEM had agreed that €2.5 million of these fees were to be paid to Fenech’s New Energy Supply Limited upon receipt of the development fee “from Electrogas Limited and Gasol plc”.

‘Please call it a development fee not a success fee’ – Yorgen Fenech

By July 2015, the interim loan by Bank of Valletta was expiring and State Aid approval of the Security of Supply Agreement was still far off. Leaked emails show that the government was still being queried by the Commission about the legality of the first State guarantee and the tender itself, among other things.

The NAO noted that on 28 July 2015, Electrogas refinanced the Bank of Valletta interim loan by entering into a €450 million Bridge Loan Facility with multiple banks (with Bank of Valletta acting as lead bank and facility agent).

Again, the government extended a State Guarantee for 80% now reaching the staggering maximum liability for the taxpayer of €432 million.

On 31 July 2015, Electrogas Commercial Director Catherine Halpin emailed the shareholders to tell them to “invoice for their portion of the success fee” which amounted to €4.166 million for each of GEM, SOCAR and Siemens.

One minute later, Fenech replied: “All, please call it ‘development fee’ NOT ‘success fee’. Catherine it is important to refer to it that way even in Electrogas records”.

Leaked emails show Electrogas’s shareholders sought to mask the true nature of the “success fees”.

Asked about the success fees, GEM confirmed both the payment of the success fees to shareholders (its total share was €6.167 million) and the fees paid to Fenech’s company (€2.5 million were meant to be paid), claiming these fees “are normal for projects of this kind” and adding that they were “pre-approved by the banks providing financing to Electrogas”.

Drawdowns under both loans were made to and approved by Bank of Valletta first as lender and subsequently as facility agent.

GEM also noted that it utilised these fees paid from money loaned to Electrogas “to fund expenses incurred by GEM … which were not recharged or refunded by Electrogas” specifically citing the fees payable to the Government for the State guarantee to back Electrogas’s loans and for bank guarantee fees put up by GEM for Electrogas.

The Shift also asked, in light of the contract with Fenech’s company, whether GEM ever received any income or fees (e.g. sharing of development / success fees) from Gasol, GEM denied receiving the same.

‘What should we tell the Commission about the development fees?’ – Siemens

By December 2015, after nine months of lengthy exchanges between the government and the Commission, the Commission concluded that the government needed to apply for approval of the State Aid rather than trying to argue for an exemption.

Further, the Commission noted, any prior advantages, including the State guarantee, were likely going to be treated as “unlawful aid”.

Siemens was worried: “It might be that [the Brussels lawyers] convinced the Maltese government that our overall deal is much too sponsors friendly … and the EU commission is only used as an excuse,” an exasperated Gerhard Brenner from Siemens told Fenech upon hearing the news. Fenech, evidently in the know, was not convinced.

“Gerhard, it’s surely not the case, rest assured I would find out if it were the case,” he replied.

Separately Markus Groner, also from Siemens, claimed: “I assume that this is where [the government] is after now,” referring to a press release about a prior State Aid case where overcompensation was avoided through an excess profit-sharing mechanism.

“From the first point of view it is, of course, unclear to me if this request was really coming from the Commission or if the [government] simply wants to make their own deal better (without external pressure),” he added.

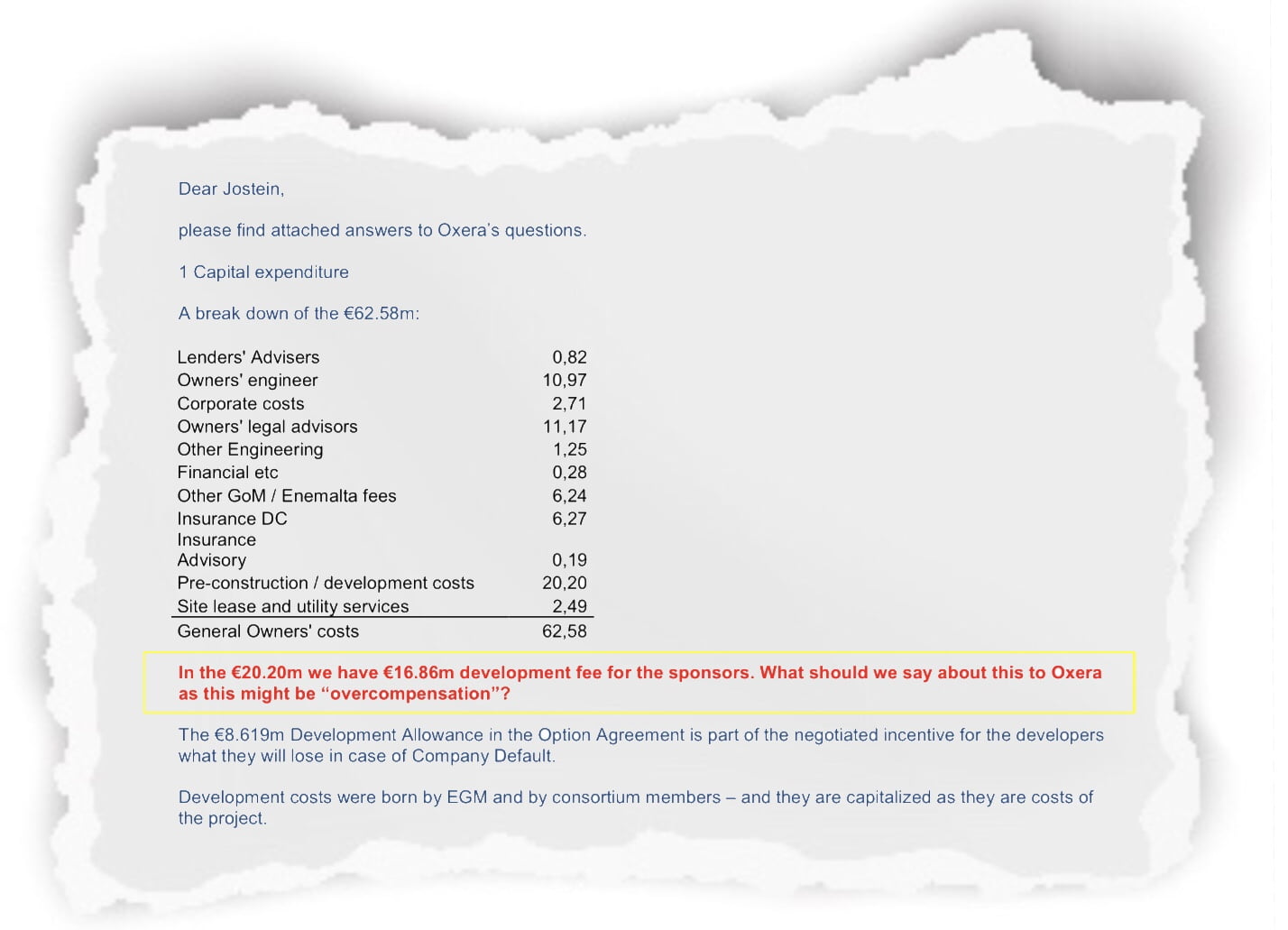

Leaked emails show that Electrogas bundled “success fees” paid to its shareholders along with development costs and expenses paid to third parties.

Fenech was having none of it. “I cannot (personally and as GEM) even consider conspiracy theories. This process is being done to please us and the lenders and not a [government] initiative in the first place.”

Emails show that notwithstanding Fenech’s attempts to comfort his partners, what was disclosed indirectly to the Commission by Electrogas reflected this fear.

“In the €20.20m (pre-construction / development costs) we have €16.86m development fee for the sponsors. What should we say about this… as this might be “overcompensation”?”, wrote another Siemens senior employee Béla Viertl.

In the end no breakdown was provided with €16.86 million in “success fees” paid to the shareholders being included instead as an expense or development cost.

With this revelation, it transpires that in calculating the return due to the shareholders of Electrogas and whether there was “overcompensation”, the Commission looked at a financial model which:

- Included €16.86 million in “success fees” paid to the shareholders as an “expense”,

- Included €40.6 million of excise tax as an expense, which amount was “forgiven” by the government at the last minute,

- Included the immediate payment of €18 million worth of Liquidated Damages plus interest, which amount was also postponed by the government at the last minute by 18 years interest free until the 10th year.

Contacted by The Shift for comment on whether the “success fees” were disclosed to the Commission, Electrogas representatives replied that “both the development fees and success fees were paid pursuant to agreements that were transparent to all parties involved in the implementation of the project”.

The private agreements referred to are a Project Services Agreement between GEM, SOCAR, Gasol and Siemens dated 28 August 2013, and a Project Services Agreement between GEM and New Energy Supply Ltd dated 1 June 2014.

Neither agreement (nor the fees paid to the shareholders under them) appears to have been disclosed to the Commission or the National Audit Office.

It is unclear whether the government or Enemalta was aware of these agreements and the distributions paid under them to the shareholders.

These new details cast further light on the internal machinations of the people behind a deal that international energy market analysts describe as one where Malta is “losing money hand over fist”.

The multi-million Electrogas project continues to be of interest to investigators and journalists alike, most notably given its potential links to journalist Daphne Caruana Galizia’s assassination in 2017.

All persons involved deny any wrongdoing. Electrogas also claims that, following an internal legal and forensic review of itself, it found “no evidence of any wrongdoing”.