Nexia BT sent a statement to The Shift as a Right of Reply, which was published in full as required by law. The Shift did state that it was not in agreement with the statements made by Nexia BT on revelations made public in the article titled ‘Nexia BT’s Brian Tonna and Karl Cini cashed in on taxpayer-funded scam’. For this reason, we are addressing the points raised by Nexia BT (you can read the investigation here).

First and foremost though, the primary question posed by the article was: What on earth are Nexia BT parties (through Capital Knight Ltd) doing as shareholders in Streamcast Group, a venture which came from nowhere and received the ‘blessing’ of each of Enemalta plc, Malta Enterprise as well as the Ministry for Tourism (Konrad Mizzi)?

The replies provided by Nexia BT ignore that key question.

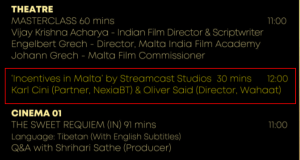

There is more to this story (some of which raise serious doubts about Malta Enterprise’s “due diligence”, the arm’s length nature of the deals and Konrad Mizzi / his Ministry’s involvement in the Malta India Film Festival organised by Streamcast). For now, we’ll address Nexia BT’s replies:

Nexia BT states: “Firstly, Nexia BT and the shareholders of Capital Knight Limited deny ever receiving any funds directly or indirectly from the sale of any Streamcast company as insinuated in the article.”

Following the sale of a number of Streamcast Group companies (and the transfer of its employees) to Iris Mediaworks in early 2019:

- Streamcast Technologies Holdings Limited (Ireland), in which Capital Knight Limited invested, was abandoned and is now dissolved after failing to make statutory filings and the resignation of its Irish service providers.

- Capital Knight Limited (Malta), the company owned by Nexia BT partners, was placed into voluntary dissolution effective 31 December 2018.

Capital Knight Ltd’s balance sheet or statement of affairs (as filed upon dissolution) does not refer to its 400,000 shares in Streamcast Technologies Holdings Limited which were acquired in June 2018. This is not addressed in Nexia BT’s statement nor are the following scenarios:

- Did Capital Knight Ltd (the company as opposed to Nexia BT or Capital Knight Limited’s shareholders) receive any funds from the sale?

- Did a third party benefit?

- Were any other funds (not arising from the sale) received by Nexia BT, Capital Knight Limited or the latter’s shareholders in relation to Streamcast’s Maltese venture?

- Generally, did Nexia BT, Capital Knight Limited or the latter’s shareholders benefit directly or indirectly from Enemalta and/or Malta Enterprise and/or the Ministry for Tourism’s support (including financial, notably for the Malta India Film Festival at which Nexia BT partners spoke on behalf of Streamcast Studios) as well as overt promotion of Streamcast?

These are matters ignored by this statement.

Nexia BT states: “Secondly, Streamcast Technologies Holdings Limited never acquired any shares in the Malta-based Streamcast Group and never had any participation in the investment made in Malta as can be easily verified by an online search of the ownership of the Streamcast group companies on the website of the Malta Business Registry as highlighted below.”

According to a reply to a parliamentary question, the Maltese company that leased out the Enemalta data centre and generally took on the “€5 million investment” is Streamcast Limited, a company with €240 in paid-up share capital. The sole director, shareholder and company secretary of this company is, according to the Maltese registry of companies, an Indian individual purporting to reside in what looks (from the outside) like a derelict flat in Mellieha without a number.

Nexia BT would be familiar with this individual given that they were shareholders with him in another related venture, Turmeric Company Limited (Malta), an Indian weddings and events company – but that would probably be another story.

The other two Maltese Streamcast companies have the same €240 in paid-up share capital and the same Indian national (along with a lawyer) as shareholders.

Taken at face value, the Streamcast Group would not even be a group at all (since they’re all owned by individuals). However, Minister Joe Mizzi confirmed in parliament that the Maltese companies “form part of the Streamcast group of companies”. So either the Minister is deceiving parliament or someone is not saying it as it is:

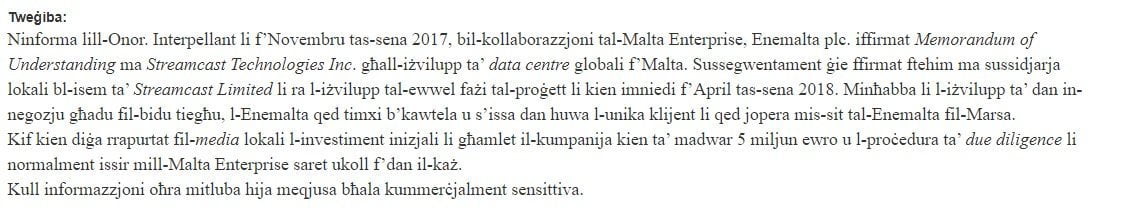

Mizzi’s reply to parliamentary question 11506 states: “In November 2017, with the collaboration of Malta Enterprise, Enemalta plc signed a Memorandum of Understanding with Streamcast Technologies Inc [the Delaware company] for the development of a global data centre in Malta. Subsequently, an agreement was signed with a local subsidiary called Streamcast Limited that led to the development of the first phase of the project launched in April 2018…

One of the photos released by the government of Minister Joe Mizzi meeting representatives of Streamcast Technologies Inc. Photo: DOI

We have come across this practice in the past, particularly with Asian companies, where the group structure is not reflected in the shares issued and held but regulated through other means such as intragroup loans and agreements to hold shares on behalf of others.

While this arrangement may not be entirely in accordance with Maltese law, we consider the Minister’s statement that the Maltese company (Streamcast Ltd), is a subsidiary of the Streamcast Group including Streamcast Technologies Inc (the Delaware company) sufficient.

Either the Minister was misled and is in turn misleading Parliament, or there is clearly more to this.

Nexia BT states: “Further, the article is also erroneous with regard to the acquisition made by IRIS Mediaworks. A proper analysis, as provided below, will show that neither any of the Malta-based companies nor Streamcast Technologies Holdings Limited (Ireland) was acquired as can be clearly seen in press releases.”

The article published by The Shift never said that. This is what was stated in the article:

“In February 2019, an Indian company, Iris Mediaworks Ltd (now renamed Jump Networks), announced that it had bought Streamcast Group for just under €2 million….”

Iris Mediaworks’ relevant corporate announcements can be read here and here.

Streamcast Technologies Holdings Limited (Ireland) is now in dissolution.

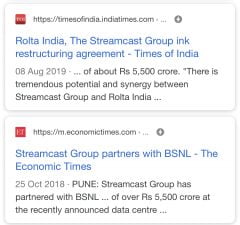

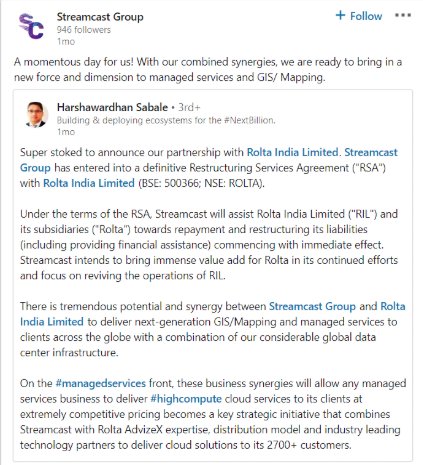

Nexia BT states: “Finally, the article is also incorrect in stating that Rolta India acquired other parts of the Streamcast Group, when in fact it was Streamcast Group which indeed acquired part of Rolta India as highlighted below.”

Public announcements by Rolta India, a company which appears to be struggling financially, were to the effect that Streamcast Group entered into a definitive restructuring services agreement with Rolta India under which, in exchange for Rolta India transferring certain parts of its business to a Rolta subsidiary (the “slump sale”), Streamcast would “invest” the equivalent of €698 million, co-incidentally the headline amount of its over-hyped investment in a data centre in India.

In exchange for this “investment”, Streamcast would take securities in the Rolta subsidiary.

In exchange for this “investment”, Streamcast would take securities in the Rolta subsidiary.

In practice, this deal was described as “combining [what was left of] Streamcast with the Rolta subsidiary” by the founder of Streamcast.

That said, we are glad to note that Nexia BT has evidently followed Streamcast’s deals closely.