-

Companies in Malta at the centre of scams by criminals that are robbing taxpayers of €50 billion annually.

-

People’s taxes used to finance terrorism, the mafia and other illicit activities.

-

Cash-for-passport schemes like Malta’s are a useful addition to fraudsters’ toolkits.

Companies registered in Malta have been found to be involved in a Europe-wide racket that is robbing European taxpayers of €50 billion annually.

A cache of over 300,000 pages of previously unseen German, Italian, Danish and Spanish tax and security services investigations, including covert recordings and interceptions, interrogations, and court documentation seen by The Shift News, provides unparalleled insight into the execution of some of the biggest scams in recent history and the players involved.

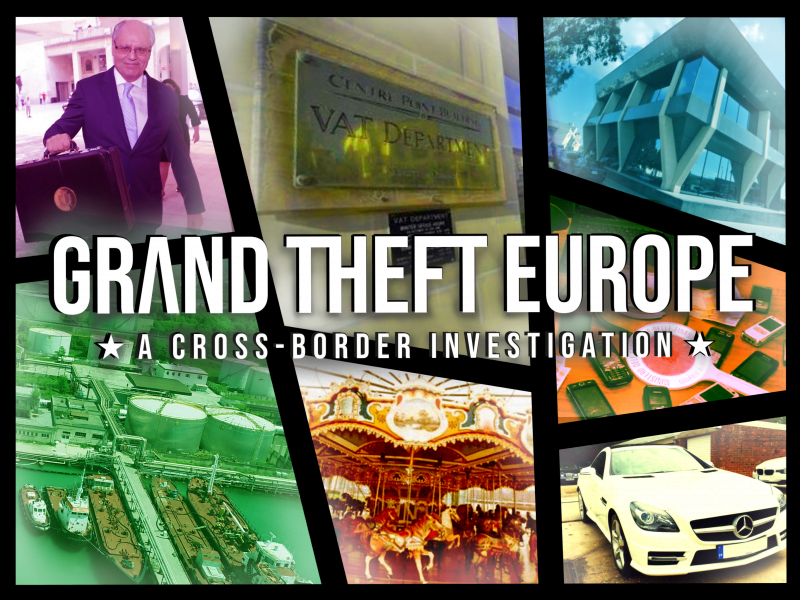

The probe is part of the cross-border Grand Theft Europe investigation, a Europe-wide investigation involving 35 media partners and covering all countries, coordinated by non-profit newsroom CORRECTIV.

The scam is referred to as Missing Trader Intra Community (MTIC) Fraud, also known as VAT carousel fraud. Companies registered in Malta, now appearing on the Malta Financial Services Authority’s register as “inactive”, are at the centre of illicit trades worth millions of euro.

Maltese entities involved in these fraud schemes are allowing criminals to steal taxpayers’ money from other EU member states, contributing to their VAT Gaps. The fraud is creating a black hole, conservatively estimated at around €50 billion per year, stolen by criminal gangs from people’s taxes and used to finance terrorism, the mafia and other illicit activity, according to the European Commission.

Malta on the radar

When Malta’s Finance Minister, Edward Scicluna, stepped onto the podium in a small conference room at the Grand Hotel Excelsior last February, he spoke of how the growth of the country’s economy under his watch was far outpacing that of European peers.

Finance Minister Edward Scicluna delivering his speech to the EU tax officials attending the 12th meeting of the EUROFISC Group Working Field 1 dealing with MTIC fraud on 6 February, 2019. Photo: DOI / C. Farrugia O’Neill

His audience could not have been too impressed. The 60 or so attendees were EU cross-border fraud and tax experts who flew in for a two-day intensive meeting of the EUROFISC network, a pan-European initiative set up to address one of the EU’s most pressing problems – VAT carousel fraud.

Malta is increasingly appearing on their radar as a big part of the problem, but the experts instead got to hear Scicluna talking about Malta’s “business-friendly” approach. Only 20 days earlier, the Italian Guardia Di Finanza (GDF) had busted yet another ring of individuals accused of running a fraudulent scheme worth just short of €8 million. The VAT carousel fraud exposed involved petroleum, and a company set up in Malta – Maloa Ltd – was part of the scheme.

Robbing the taxpayer

In September 2018, the European Commission published its 2016 statistics on the VAT Gap in the EU. Malta scored an impressive 90% reduction in its own VAT Gap, to a manageable €20 million of uncollected VAT. But this did not tell the full story.

The cache of documents from tax and security services investigations seen by The Shift News as part of the cross-border investigation shows that the criminals involved in the design of these schemes openly discuss using Malta and consider it to be a handy jurisdiction to set up companies to include in these illicit structures. Not least since, due to EU membership, it cannot be blacklisted.

VAT carousel fraud is often referred to as ‘a crime against Europe itself’ because fraudsters abuse of the internal market and cross-border exemptions from VAT to set up cross-border webs of companies to import and export goods, rack up significant amounts of VAT, never pay it, and later claim a refund through another company.

Fraudsters may even re-import those same goods and run them through the import / export network (carousel) again, multiplying the damage to the taxman.

In its efforts to combat this crime, the European Commission has launched an action plan on VAT, and an explainer video on how VAT carousel fraud hits taxpayers.

Taxation | VAT carousel fraud accounts for €50 billion lost annually. We need to stop criminals & #StopTheCarousel. https://t.co/RsIkqu5WxR pic.twitter.com/SHMt1euM2O

— European Commission (@EU_Commission) August 3, 2017

The goods ‘go round and round’

Since VAT carousel fraud is a crime, any banks and service providers involved – even minimally – in the establishment of the scheme or the handling of its proceeds could also find themselves facing charges of aiding and abetting money laundering or even the financing of terrorism.

Although VAT carousel fraud theoretically requires just three companies (the company exporting, the importer / missing trader, and the company later claiming the illicit VAT refund), fraudsters wanting to avoid swift detection will aim to blur the links between the three companies as well as their common ownership or control.

This will typically involve the use of nominees or ‘straw men’ (or both) as well as the inclusion of other companies in the trading chain acting as intermediaries or ‘buffers’.

Fraudsters are aware that while EU tax authorities collaborate across borders, the larger the number of authorities required to get involved (particularly those less sophisticated or with less resources and less responsive) the longer the time it will take for the fraud to be uncovered. The end result is often a labyrinthine network of dozens, sometimes hundreds, of companies spanning multiple countries – and those are just the ones caught.

Criminals like ‘business friendly’ governments

It is here that Malta and its “business friendly” government policies, including one-stop shops to swiftly set up VAT registered companies stands out.

With a vast array of corporate service providers offering quick company formation and nominee services, combined with under-equipped and understaffed regulatory authorities, Malta is a prime location as a node in the network.

This did not start yesterday – some of the scams being unravelled involving Malta date back almost a decade. It is a risk with all countries positioning themselves as “financial services jurisdictions”, but when compliance and supervision is sacrificed, the likelihood of Malta being used by criminals increases significantly.

The cache of documents investigated shows that crime kingpins openly boast about this, as well as smaller fry such as a former Admiral in the Italian navy Giovanni Di Guardo, referred to as “the Admiral from Catania with a habit for crime”. He boasted of his fiduciary company in Malta, saying he could “transfer funds while by the pool in Romania,” the documents show.

Last April, the Italian media reported on the most recent accusations he is facing: “Taking advantage of the fact that there is a permanent Italian military mission of assistance to the Maltese army, Di Guardo is accused of devising a [VAT] carousel fraud by setting up a company in Italy and another in Malta. The first bought branded clothing without paying them, using his rank in the army to obtain credit from the main fashion houses of the Belpaese area”.

Two years ago, Di Guardio was arrested in a separate case for rigging contracts worth €11.5 million.

Convenient passports

Di Guardo’s is one in a string of cases exposed involving Malta-registered companies. And Malta has added to the arsenal in the fraudsters’ toolkit.

Malta’s track record in VAT carousal fraud schemes uncovered includes companies that never even submitted VAT returns or audited accounts, yet no red flags were raised.

According to VAT fraud expert Marius-Cristian Frunza, most of the big VAT carousel fraud cases involved gang members holding at least two different passports. In order to hide common ownership of companies in a carousel, some fraudsters opt to create multiple identities without even needing forged documents.

When an individual from a country that uses a different alphabet purchases a passport, the name is often interpreted differently, creating a variation. A new nationality, a different passport number and a different name is, in effect, a new identity.

So criminals can open companies and bank accounts in different countries using two or more different passports with different names. This makes it extremely difficult for law enforcement authorities to accurately assess the full extent of the individual’s involvement in the cross-border crime.

EU lawmakers have strongly recommended the phasing out of golden visas and cash-for-passport schemes in Member States, saying they carry significant risks, including a devaluation of EU citizenship and the potential for corruption, money laundering and tax evasion. The Maltese government has denied this.

Malta’s track record in VAT carousal fraud schemes uncovered includes companies that never even submitted VAT returns or audited accounts, in breach of the law. One of these companies, that joins others on the Register of Companies as “inactive” after the money disappeared, had a €50 million turnover in its first year of operation. Yet, no red flags were raised.

The Shift News has asked the Finance Minister for a reaction.

In the next story: Fraud by companies in Malta exposed

________________________________________

For Grand Theft Europe, The Shift News teamed up with a network of 35 European media partners from every European country, coordinated by the German non-profit newsroom CORRECTIV. Together the network is investigating VAT carousels, the biggest ongoing tax fraud in the EU. The investigation has resulted in numerous stories, a podcast and a number of TV documentaries.

The project: www.grand-theft-europe.com