-

From Oman to the Balkans, VGH has been busy riding on the platform given by the Maltese government to secure lucrative deals abroad.

-

The company was giving presentations to other governments even as it knew it could not deliver in Malta after receiving some €50 million from taxpayers.

-

VGH’s book value is reportedly close to worthless but, provided the VGH companies are bought out, any contracts that it has managed to ‘bag’ will offer a generous and long term return for its contractors and suppliers

There is a bigger picture to the scandalous Vitals Global Healthcare (VGH) deal that has managed to slip below the radar – while packing its bags in Malta, VGH has been busy securing other contracts overseas enabled by the government of Malta.

A fair amount of media coverage has been dedicated to the fate of the local concession and the dire financial situation of those who appear to be ‘on paper’ VGH’s shareholders. Little has been written (and little was known) about VGH’s activities outside Malta and how these will be affected by (and likely precipitated) its present financial troubles.

In what is eerily similar to the Gasol plc / SOCAR gameplan (secure a concession under less than transparent conditions in Malta to use as a showcase elsewhere – in Gasol / SOCAR’s case West Africa), the hidden investors behind VGH, together with their fronts Sri RamTumuluri and Mark Edward Pawley, made no secret of their intention to ride on the back of the Malta Private Public Partnership (PPP) and emulate it elsewhere.

The government has been silent over several aspects of its deal with Vitals Global Health, the company granted a concession to run three public hospitals for up to 99 years. The Shift News collaborated with The Sunday Times of Malta to reveal the results of investigations so far. Now, The Shift News has again dug deeper.

Tumuluri’s bio on the CWIEC website makes this plan explicit: “Mr Tumuluri’s role within VGH is to focus on developing PPPs across the world. Malta is the first PPP for VGH, however the target is to achieve 8,000 beds over the next five years.”

Tumuluri featured in the Commowealth programme when the event was hosted by the government of Malta in 2015.

On 21 October, 2015, a month before the company signed the actual concession agreement with the Maltese government, VGH was delivering a presentation in Oman to design, build and operate a 180-240 bed hospital touting the Malta PPP as its credentials:

“[VGH] has been appointed by Government of Malta (an EU Member State) to operate and manage their health care system”

“VGH has bagged €210 million investment at St Luke’s Hospital, Karen Grech Rehabilitation Centre and the Gozo hospital in Malta”

The presentation was given to the Duqm Special Economic Zone Authority. It does not appear that this particular pitch was successful. Yet, by March, 2016 (the Maltese concession agreement had not even become effective yet), aggressive marketing and lobbying by Tumuluri along with others such as Shaukat Ali Abdul Ghafoor appear to have borne fruit.

Prof Albert Fenech’s letter of resignation to former Opposition Leader Simon Busuttil, as well as the enclosed letter from Tumuluri, mention that VGH managed to secure agreements with the Government of Georgia to build and operate a 600-bed hospital in Tbilisi and over 200 primary care centres across the country.

Tumuluri also goes on to note that VGH “is working with the governments of Slovakia on a 1,000-bed hospital in Bratislava, a 400-bed hospital in Albania and a 300-bed hospital in Montenegro.”

The letter also refers to “potential business development plans in Sub Saharan and Northern Africa” as well as a joint venture agreement with Dubai Healthcare City. Again, little is known about what became of these ventures.

The Shift News previously reported how VGH had, just like it did in Malta, signed a pre-tender secret agreement with the Montenegro government in August 2016, months before it went on to win what was in effect a done deal for a similar PPP. We know what happened there.

VGH pitched the idea to members of the government of Montenegro and signed a hidden deal before the public was informed of a partnership on the country’s hospitals. In Malta, the secret agreement with the government was signed five months before a call for proposals was issued, ensuring Vitals ‘won’ the bid.

The difference between Montenegro and Malta is that the Montenegro deal was later cancelled following a change in government.

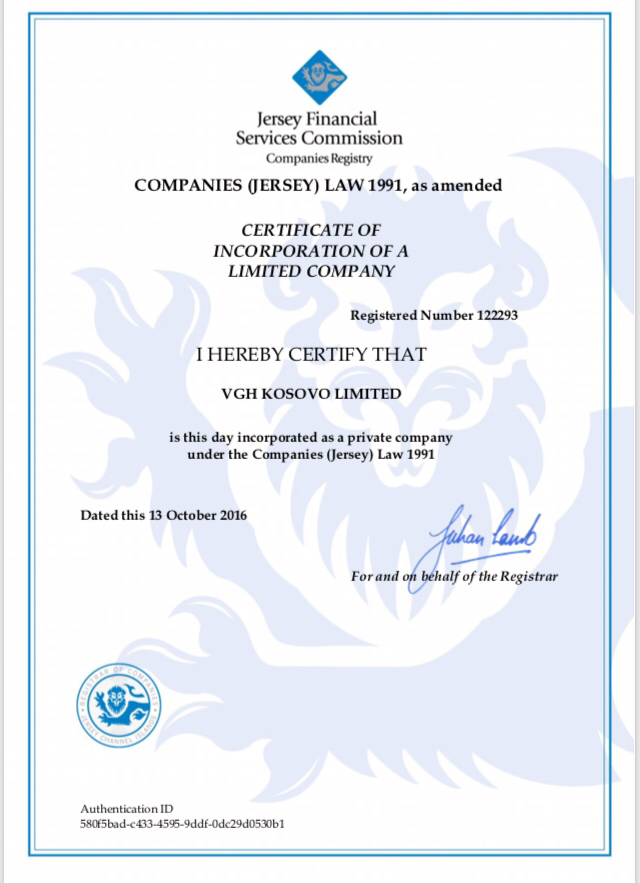

The Shift News further revealed how VGH had established a Montenegrin subsidiary in anticipation of the deal. Additionally, it established 12 Jersey companies, one of which was called VGH Montenegro Ltd and another VGH Malta Ltd evidently intended to house the Montenegrin and Maltese operations, according to legal and financial experts.

The name of another Jersey company – VGH Kosovo Ltd – established on 13 October, 2016 offers a clear indication of its intended purpose. Online searches regarding VGH’s activities in Kosovo are scarce. Information is limited to a presentation delivered by Tumuluri and Armin Ernst on 17 November, 2016 in Kosovo in the presence of Kadri Veseli, Kosovo’s Chairman of the National Assembly.

Ernst, the former CEO of VGH, is now president of Steward Healthcare, receiving the VGH hospitals concession.

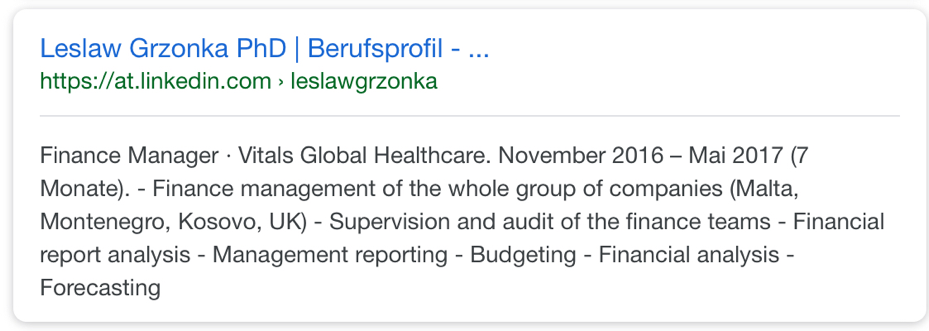

Again, not much is known about what happened in Kosovo other than that VGH saw fit to set up a holding company for a Kosovo venture a month before delivering a presentation in Kosovo. The LinkedIn profile of ex-employee Leslaw Grzonka referred to VGH as having a group of companies in “Malta, Montenegro, Kosovo, UK” (the profile has since been amended).

In the late summer of 2017, at which point VGH was already engaged in talks with Steward Heathcare for a bail out, it seems that Tumuluri, Pawley and Shaukat Ali were still seeking to spread VGH’s international footprint, this time with a presentation to the government of Macedonia.

At that point, it would have been expected that VGH would be more concerned with saving its operations from financial meltdown than trying to expand further.

Rum Tumuluri giving a presentation to representatives of the government of Macedonia. Shaukat Ali Abdul Ghafoor, a hidden Pakistani stakeholder in the Malta Vitals, who is also suspected to be a front for others, is also present (far right).

The logos of VGH partners and contractors at the bottom of the slide (including Ohum Healthcare (VGH’s IT service provider) and Technoline (VGH’s medical supplies provider) on the screen provide a solid clue to VGH’s priorities.

VGH’s book value is reportedly close to worthless but, provided the VGH companies are bought out, any contracts that it has managed to ‘bag,’ not just in Malta but also in other countries, will offer a generous and long term return for its contractors and suppliers, each of which is likely have global exclusivity agreements.This has been confirmed by sources close to the industry.

Notably, Technoline’s press release in July, 2017, announcing its exclusivity agreement, included the following line: “Technoline Ltd will manage the supply chain processes of all VGH life-sciences entities in all geographies internationally.”

To comment on this story or anything else you have seen on The Shift News, please head over to our Facebook page or message us on Twitter.