The government plans to borrow a further €1.5 billion this year to supplement its spending, according to its plan published this week as required by law.

Finance Minister Clyde Caruana announced that the government will issue more bonds to ensure it has enough money to sustain its growing expenditure.

Despite the government boasting of economic growth higher than the average in the EU, it still has to increase its borrowing requirements to counter rising expenditures across most sectors of its administration.

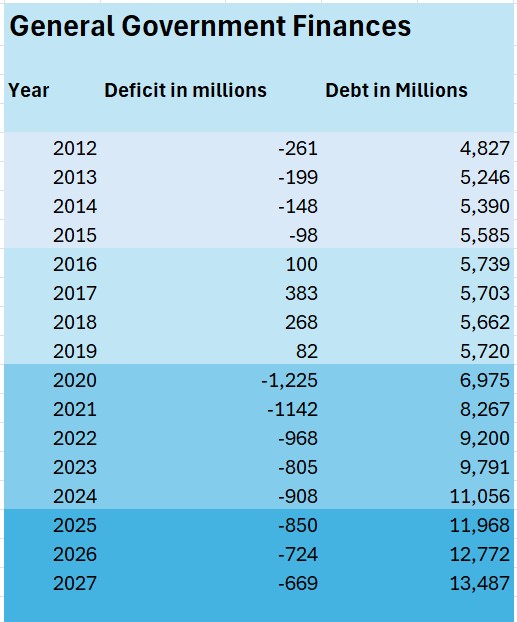

Most of this year’s borrowing, a staggering €850 million, will go to service the deficit planned for the current year, as announced in the last budget.

Additionally, the government will need to borrow another €540 million to pay back existing bonds that mature during the year.

The government’s new borrowing requirements are expected to increase the island’s growing debt, which is expected to reach almost €12 billion by the end of the year.

This means that since Robert Abela’s time at the helm of government, the island’s debt will double, from less than €6 billion in 2020 to €12 billion by the end of the year.

The increase is also significant compared to the Gross Domestic Product (GDP).

While Malta is recording a consistent growth rate, surpassing 4.5% in 2024, it is still not managing to take advantage of a favourable economic climate and reduce its deficit.

While the government is estimated to close 2024 with a debt of 49.5% of GDP, this will increase to 50.1% by the end of 2025 amid a strong economic forecast.

According to Finance Minister Clyde Caruana, Malta is expected to close 2027 with a debt of €13 billion—the highest ever recorded in the country. This debt will require €400 million a year in interest payments.

In most democratic countries, this bag carrier would have been fired long ago.

This has nothing to do with planning or any kind of know-how.

(The only thing I can think of in his favor is that because of the crime in the government, more money was and is being used for non-government projects.)

This is the equivalent of a company borrowing money year in year out to pay the wages.

Every stupid who has a bank account know what this means.

YOU’RE BANKRUPT.

Who is going to pay tax payers? Cap cap gahan0

We know where a lot of that money will end up, in the swine trough which gets bigger and bigger, ‘bravu ministru, icapcap gahan’!

This government is living way beyond its means. The decrease in the deficit correlates to much higher increases in debt. On the one hand, there is a need to pay for increasing current expenditure arising from higher government employment. On the other, there is capital expenditure, which includes all projects as well as the leeching of public funds into private pockets. Then of course there is the cost of servicing and repaying debt, by replacing it with new and increased levels of the same. The government is robbing Peter to pay Paul. In what starts to look like a Ponzi scheme. Spiraling costs also bring in worries of inflation.

GDP may be high but with an economy dependent on construction and tourism alone, supplemented by the importation of cheap foreign labour to keep costs down, in turn placing higher demands on the economy and infrastructure, is a pile of cards set to come crashing down. Property prices are unnaturally inflated in a bubble that has so far refused to burst, but which does show signs of bursting at the seams, and which has the potential to cripple investors and lead to foreclosures.

Unless excessive government debt can be curbed whilst controlling the deficit, a government that has no control over its monetary or interest policies is left with no other option but to resort to fiscal policy.

As I see it, the future doesn’t bode too well.

when it’s over, they will leave the debt-ridden island to go and live in Dubai, where they have already invested their funds