The new Beverage Container Refund Scheme (BCRS) announced on Monday it has reached the one million bottles deposited mark, but since the scheme was launched a week ago it seems to have had an equal number of complaints.

The scheme has been controversial since its conception, but with its launch on 14 November some have welcomed it while a growing number of others are labelling it a mere greenwash and an economic and environmental scam effectively forcing a 10-cent tax on every beverage in a plastic receptacle people buy.

The scheme’s directors are Malta’s largest beverage companies and include representatives of Farsons, Marsovin and General Soft Drinks, among others.

A 10-cent charge is being placed on each and every such beverage, which is passed on to the consumer when it is purchased. Once consumed, the used plastic container can be put, in its pristine state if it is to be accepted, into one of BCRS’ Reverse Vending Machines, and consumers receive not their 10 cents back but, instead, a voucher for 10 cents that can be redeemed only under certain conditions.

Moreover, many people are often finding the Reverse Vending Machines full to the brim and unable to accept more bottles once they do get to them. Others consumers still have found the machines not only difficult to find but cumbersome and complicated to use.

The fact of the matter is that each time someone does not feel like going through the laborious process, they have effectively been taxed the 10 cents tacked onto their drink’s retail price.

That, coupled with the inherent difficulties of using the machines, has led critics to accuse the BCRS system of having been designed to fail, and possibly for good reason.

The scheme’s one-million-bottles-in-a-week figure works out to refunds, in the form of vouchers, of €100,000 over seven days. But it could very well be the millions more of unreturned bottles that the scheme’s operators are more interested in.

According to the scheme’s many detractors, that is precisely what those behind it are banking on: people not bothering to return the bottles and the 10 cents per receptacle ending up back in the pockets of the drinks manufacturers and importers.

And it appears to be a win-win situation for those behind the scheme because the bottles that are returned, since no local recycling facilities are involved in the scheme, are exported to unknown destinations for recycling, again, at a profit, or otherwise, it is also being speculated, to simply be dumped in a foreign landfill far from Malta.

An intentionally difficult system?

It is argued the scheme appears designed to disincentivise the public’s participation.

While BCRS said on Monday it plans to install more Reverse Vending Machines, over and above the 320 it says went live on 14 November – although figures tabled in parliament on Tuesday show a total of 274 – there are numerous complaints from consumers about their sparsity and that, when they do get to them, the machines are often full and unable to accept deposits.

Others still have been finding the machines complicated to use and are frustrated over the number of vouchers the machines issue, one per bottle deposited, which makes it a lengthier and more cumbersome process.

And there are more problems still once consumers go to cash in their 10-cent vouchers. One cannot simply get cash back for their vouchers as they instead need to be deducted from the bill at a retail shop in which beverages are sold.

That is in the case of vouchers issued by public Reverse Vending Machines.

If, on the other hand, the vouchers are issued from machines located at a supermarket, they can only be redeemed against a bill from that particular supermarket or at one of the other outlets in the same chain should that be the case.

While it is more than apparent that many people out there are simply not bothering to engage with the scheme and are simply disposing of their plastic drink receptacles as before with their recycling, social media has been rife with tales of people collecting those bottles from residential garbage bags.

They are, however, being disappointed and turned away from the machines because bottles cannot be accepted unless they are perfectly intact. As BCRS makes clear, “the beverage container needs to be returned empty and in good condition, with its shape still intact and barcode clearly readable, ideally with the cap on to maximise recycling”.

A chequered origin

The scheme’s shareholders count among them the country’s biggest bottlers and drink importers, who all stand to gain one way or another even though they have invested €17 million into the system.

The scheme’s shareholders are Charles Grech & Co Limited, The General Soft Drinks Company Limited, Simonds Farsons Cisk and GSD Marketing Limited, which all own a small 0.0853 per cent share in the enterprise.

The larger shareholdings (of 33.2194 per cent each) are held by the Malta Beverage Importers Association (whose directors include representatives of Charles Grech Limited, Nestle Malta and P. Cutajar & Co. Ltd), the Malta Beverage Producers Association (whose directors include representatives of Farsons and Marsovin), and the Malta Beverage Retailers Association (whose directors include representatives of the Malta Chamber of SMEs and of a number of large supermarkets).

The scheme, however, has a more chequered origin story, with it having been first conceived by the business partner of former OPM chief of staff Keith Schembri, Malcolm Scerri.

The bottle return system had first been announced seemingly out of the blue by then prime minister Joseph Muscat in 2017 in his speech marking the first 100 days of that legislature. He pledged at the time that 70% of Malta’s bottles would be recycled by 2019.

Scerri, through a company he owned and directed – was the Malta representative of Tomra, a Norwegian multinational recycling solutions corporation.

Scerri’s company was set up in May 2014, well before Muscat’s announcement that the government was looking into a plastic bottle return system, but over a year after the Labour Party was swept to power in March 2013.

Scerri was at the time involved in a number of companies, all of which were registered at either Schembri’s Kasco premises or his personal address. But Acumen, the company that was once in the running for the contract, was actually registered at the office address of Nexia BT of Panama Papers-Mossack Fonseca fame and in which its head, Brian Tonna, had been heavily implicated.

The firm housed Mossack-Fonseca Malta before the company left the country in the wake of the scandal. It had also engineered the overseas financial machinations of Minister Konrad Mizzi and Keith Schembri.

Schembri and Scerri were also revealed in the Panama Papers as having had companies in the British Virgin Islands. Scerri had taken over the management of Schembri’s Malta-based Kasco Ltd and Kasco Engineering when Schembri was appointed the Prime Minister’s Chief of Staff in March 2013.

Source: The Times of Malta

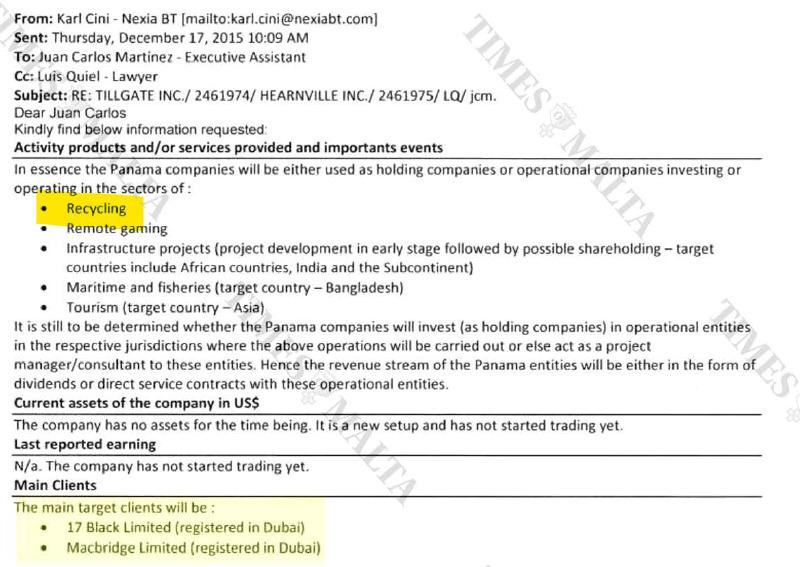

A December 2015 email leaked in the Panama Papers showed Schembri, as well as former minister Konrad Mizzi, had intended to use his Panama company as a holding or operational company investing or operating in the area of recycling, among other areas of operation.

They also said the ‘target companies’ of that recycling business would be the now-infamous 17 Black, owned by Yorgen Fenech, and Macbridge, owned by the mother-in-law of Enemalta and Montenegro wind farm negotiator, Chinese national Chen Cheng.

Peress li l-konsumatur dejjem bil-flixkun ma’ halqu, u b’xi 5 pakketti fil-garaxx jew fil-kcina… l-imhuh wara din l-iskema qed izommu ghandhom flus tal-konsumatur li l-istess konsumatur ma jirkuprahom qatt ghax meta jgibhom lura jerga’ jonfoqhom. Il-miljuni li dawn il-kumpaniji l-kbar qed izommu ghandhom – ghallinqas dik biss – digà hija serqa legali sfaccata ta’ flus in-nies.

Firstly when comparing to Germany, who has such a returns’ system, the taxed bottles, cans etc. are labeled as such. How would customers know which bottles, cans etc. are in the BCRS scheme or not? Something is odd! Why are these items properly marked?

Secondly I recall reading that this system is partly intended to offset eco taxes that producers and importers are liable for under EU Directives. The idea is that these producers and importers are transferring their responsibilities onto the clients while possibly even profiteering along the way.

There is a reason why behind the BCRS scheme are these very same producers and importers that would otherwise be liable to pay taxes for their products or imports. The Shift Team, we need you to unravel the truth behind this scheme!

https://www.european-bioplastics.org/policy/single-use-plastics-directive/

https://environment.ec.europa.eu/topics/plastics/single-use-plastics_en

https://environment.ec.europa.eu/topics/plastics/single-use-plastics/eu-restrictions-certain-single-use-plastics_en

https://www.europen-packaging.eu/policy-area/single-use-plastics-directive/

Excellent, excellent reporting and study into the DNA of the lowest form of thievery – stealing from and hoodwinking the people into having faith in a mafia of the lowest form.

One can hear their conversations prior to the ‘13 election – ‘Okay – let’s talk moneeeeeeey’.

This is highway robbery by stealth.

The St Paul’s Bay Council had this already organised and running by a PN Council. This was killed by the Labour Government because , this was in their Road Map and could not allow a functional efficient competitor to be years ahead of theirs, managed by the one and only Keith Kasco Schembri and friends.

As far as I know , there is already a recycling tax on everything that is imported .

So this is a double taxation , hidden behind a recycling payback system , that if it does not work , makes more profit.

Yes, you read it right, a Business that Makes More PROFIT , if it does not run 100% efficiently, actually it makes a killing , sort of, if nobody returns one single bottle. Put glass back in the system , returnable to the seller , who sends it back to the supplier in his own crates.

Anything that Schembri is involved in stinks to high heaven

A couple of local bars have increased their prices by 10 cents. Does that mean I should take the containers away to redeem them? If not, they have just increased their profits.

I am being charged 3 euros a week and yet never finds an empty machine. Always full why just one container for plastic bottles. This is not fair for us. Hidden tax?

No, it’s not a hidden tax. It’s basically another “corruption tax”

In any other European country, when a group of competing manufacturers or suppliers get together and agree to extort price increases from their customers this would be deemed to be an illegal Cartel.

In this case they actually managed to bypass the law by getting the government to make it illegal for retailers not to participate.

One thing you missed in your excellent investigation is that besides the 10 cent mark up for consumers, retailers who have been ‘chosen’ to participate are obliged to pay a yearly ‘Participation Fee’ based on the square meterage of their premises to BCRS.

This fee ranges from 25 to 100 Euros annually so the machines will probably eventually be funded by the retailers and not by BCRS!

Retailers also have to pay BCRS to have the containers collected on unscheduled days!

Here is the link to their ‘Participation’ page.

https://bcrsmalta.mt/participation/

This scheme is an utter fraud of people’s money. What a shame

I’ll let you know when I’ve recycled the 20+ empty, perfect condition, plastic bottles at the weekend …

This whole scheme should be avoided and the drinks boycotted until they remove this stealth tax, shame on them utter thieves who couldn’t care less about recycling. BTW i tried this initiative at three different outlets all of them were full or on reject of the bottles.

Stop purchasing drinks that are, after all, unhealthy!

This scheme was conjured after a Kasco subsidiary got the exclusive rights for the machinery.

It is clearly day light robbery..as the company collects all the money immediately, and only a small % is returned as it is complicated and time consuming..so the company is left with hundreds of thousands guaranteed profit each month especially in summer

If we are already paying eco tax on such plastic and importation why are we paying another 10c cent over and above eco tax? Why are we not refunded eco tax instead for recycling all products that need to be recycled and not just the products of these monopoly giant businesses?

Recycling the millions of plastic bottles would be very important. But this kind of solution is not the good one and therefore isn’t helps, because sooner or later most people will not use the BCRS machines. They will accept the raised price as a part of the inflation, and don’t bother the recycling.

What the actual… better machines than that have existed since I was a child. In Finland for at least 2 decades all bottles have the container deposit included in its price. Machines are placed in every large supermarket, issue a single receipt for all your bottles, and is accepted in the same shop where the machine is. Super easy, super convenient, and helps to keep bottles out of the environment. I have yet to find a machine who is full, or that wouldn’t immediately be emptied by the shop staff.