Remote gaming operator Online Amusement Solution Ltd was slapped with a fine amounting to €386,567 following the Financial Intelligence Analysis Unit’s (FIAU) review of its anti-money laundering and counter-terrorism financing procedures.

Besides the fine, the company is also subject to a Follow-Up Directive, which means it has to provide financial authorities with an action plan to amend the several shortcomings flagged.

According to the FIAU’s official notice, 14 different sub-regulations from the Prevention of Money Laundering and Funding of Terrorism Regulations were breached, including basic customer risk assessments, lacking information on clients’ occupations, and failing to have adequate transaction monitoring systems.

One of the more severe breaches identified by the FIAU’s review committee also included the company’s failure to submit a suspicious transaction report in spite of its knowledge of one client funding his online wallet using a stolen credit card.

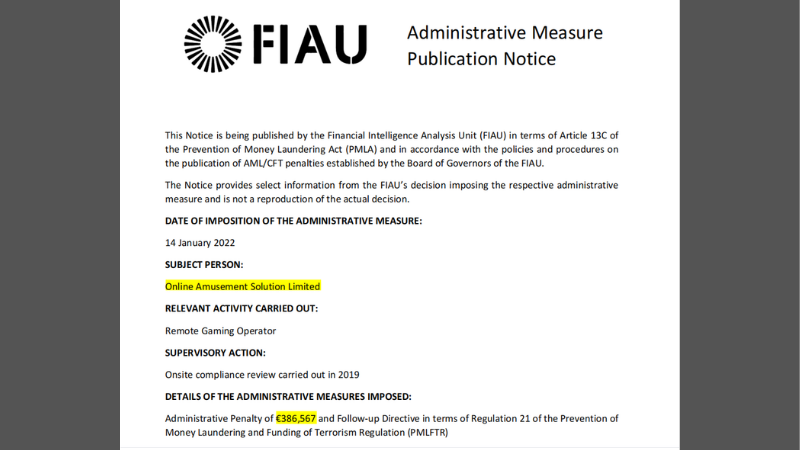

A snapshot of the FIAU’s report on Online Amusement Solution.

“Further to this, FIAU officials conducting the examination were informed that any suspicious behaviours or transactions would be verbally communicated by the third‐party providers to the MLRO,” the FIAU’s report states.

“Yet, no reports were ever submitted both internally to the MLRO (money laundering regulations officer) or externally to the FIAU,” it adds.

Out of 31 sample player profiles reviewed by the FIAU, Online Amusement Solution, listed as owned by Greek national Thomas Platsatouras, could not provide any information on how customer risk assessments were carried out for 26 of those profiles.

“The only five player profiles with a risk rating assigned were players of another licensed Maltese entity which was making use of the Hellenic Authorisation held by the company,” the report states, referring to an authorisation granted through Greek authorities, where the company originates.

“The company could not even provide any comprehensive insight as to how the assessment was carried out. The Committee noted that there was an overall lack of understanding of customer risks, not only on paper but also in practice,” the report adds.

In the same sample of 31 profiles, 28 of them were found to have no information whatsoever on the clients’ occupations, raising further red flags on the company’s verification of sources of income.

Online Amusement Solution also failed to carry out adequate enhanced due diligence (EDD) on clients, with requests for tax returns from players going unanswered 80% of the time.

“One of the players had submitted two tax returns which indicated that he earned over €9,000 in 2016 and over €13,000 in 2018, and yet in a period of over two years he had deposited over €195,000 using six different payment methods,” the FIAU report states.

Other failures highlighted by the report include failure to keep adequate checks for politically exposed persons, provide training for staff members relating to anti-money laundering and counter-terrorism financing procedures and a thorough assessment of the company’s potential risks.