The infamous Pilatus Bank has received renewed scrutiny throughout this week as its Hong Kong-based parent company seeks to strengthen its claims against the Maltese State for having used the process of winding down the bank to dismantle its assets for the enrichment of individuals involved in the process.

In its submissions to a US court, the parent company, Alpene Ltd, owned solely by former Pilatus Bank owner Ali Sadr Hasheminejad, has called for the court to summon former Promontory Financial Group executive Elizabeth McCaul for allegedly facilitating the stripping down and seizure of the bank’s reserves.

McCaul, representing a consultancy firm that was repeatedly used by the Malta Financial Services Authority (MFSA), had appointed Lawrence Connell, another Promontory consultant, to oversee procedures after Pilatus Bank’s licence was revoked in June 2018.

Only six months after his appointment as the competent person in charge of overseeing the winding down of Pilatus’ operations, Promontory was given a €345,000 direct order from the Finance Ministry to review the bank’s operations.

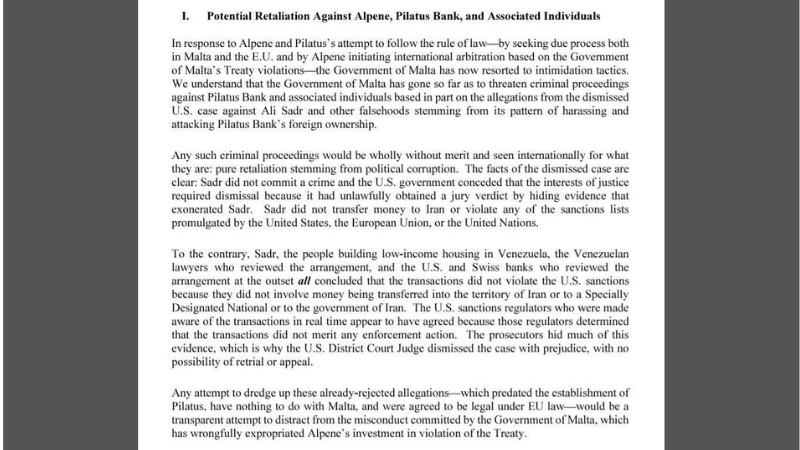

A segment from Alpene Ltd’s argument against the Maltese State.

The intensity and the timing of Hasheminejad’s attempt to turn the tables on the Maltese State seems to suggest the banker is keen on avoiding any kind of extradition to Malta, essentially launching a preemptive strike while Maltese courts prepare to finally prosecute Pilatus Bank officials.

Alpene Ltd is claiming that it had not found enough evidence to support Connell’s appointment to the role since he lacked relevant experience while also maintaining that Connell had liquidated the bank’s assets as well as draining its finances through exorbitant rates via an agreement with law firm Mamo TCV advocates.

Hasheminejad’s company also claimed that the Maltese State had failed to acknowledge the overturning of a guilty conviction for Ali Sadr, who was facing potential 85-year prison sentence for breaching US-Iran sanctions and bank fraud. The case against Hasheminejad was dropped last year after US prosecutors had failed to disclose all information submitted against the Iranian banker for the scrutiny of his legal team, essentially earning him a ‘get-out-of-jail-free’ card.

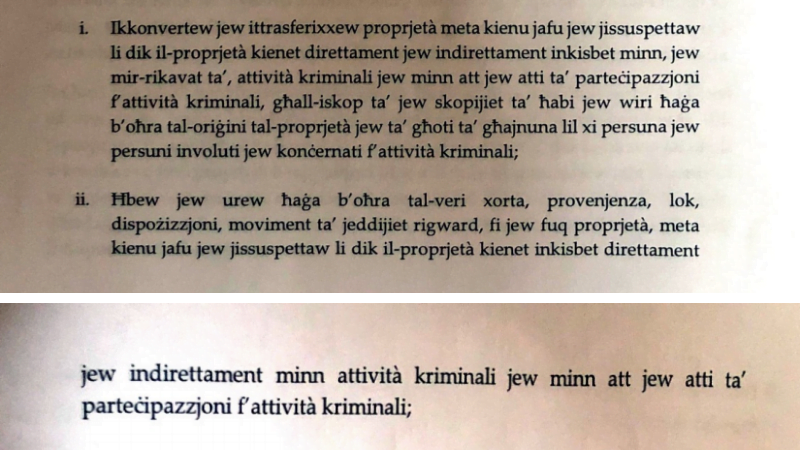

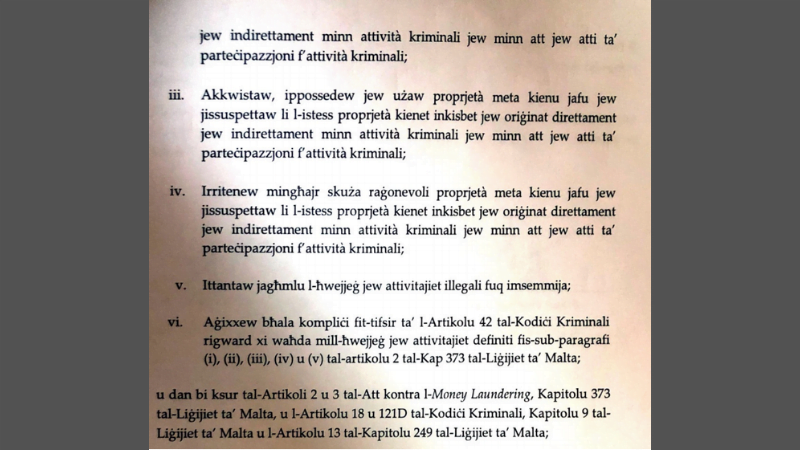

The case is currently being heard at the International Centre for Investment Disputes. Meanwhile, on Thursday, former Pilatus Bank officials have been arraigned in court after another year of radio silence from the authorities.

The case being heard before the local courts is based on the results of a massive €7.5 million magisterial inquiry into the bank’s affairs that was concluded in December of last year.

According to court blogs documenting Thursday’s proceedings, the inquiry had directed criminal action against nine individuals in total. It is also linked with a recently released FIAU report that justifies a €5 million fine issued to Pilatus three years after its doors were shuttered.

The FIAU report found that Pilatus Bank had failed to adequately scrutinise most of the transactions it oversaw, with several recorded instances in which the bank failed to query unexplained wealth or even accounts which recorded far more income than what was originally expected.

Earlier on Thursday, Pilatus’ former Money Laundering Reporting Officer, Claude-Anne Sant Fournier, was arraigned and charged with failure to ensure adequate scrutiny of Pilatus’ financial operations, with police inspectors outlining how she expressed her right to silence over the course of four interrogations since 5 April.

Sant Fournier was granted bail due to the lack of reasonable fear in terms of tampering with evidence or escaping from the country. Pilatus Bank’s remaining assets were frozen.

Pilatus Bank itself was also charged. Fabio Axisa, a partner at PWC Malta and current administrators of the bank, appeared on behalf of the bank in his capacity as an administrator.

What a mess these BASTARDS brought us in. The artful corrupt,greedy dodger is the main cause, and wonder of wonders he’s still running free with konrott mizzi, casco and the coconut.

The Mafia know how to ise the law when they need it.

Can’t imagine why lawyers are mostly reviled when they defend the indefencible. Oh hang on, yes, it’s money. As usual.

Ara fiex daħħluna u ara fiex ġabuna.

Tlaqna Ta’ Xbiex niċċelebraw fuq it-taraġ.

And Papaya offering crypto services in Malta via BlackCatCard under the nose of MFSA, which does not “know” anything .

In this country, there are crooks within the Institutions. But they are less competent than the other crooks outside the public sector.

Malta is a jungle for the honest, law abiding people. But a paradise to these crooks.

Life works like a computer log in garbage then we get garbage out